Daily Business Report: Dec. 11, 2024

Visual Capitalist

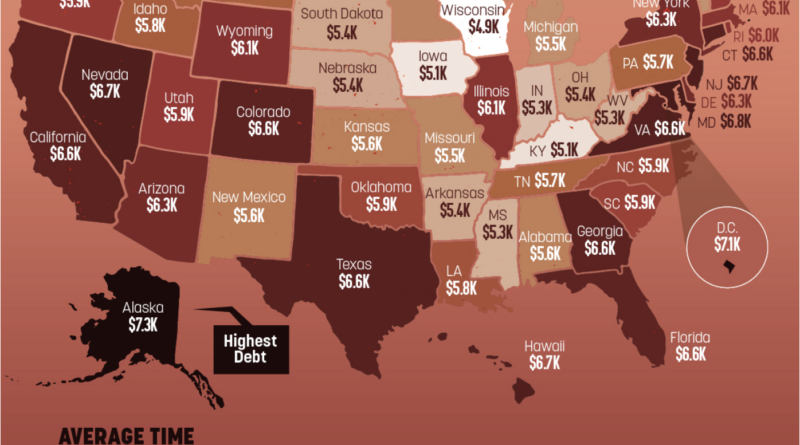

Mapped: The Average Credit Card Debt in Every U.S. State (2024)

By Pallavi Rao

This map visualizes the average credit card debt held by households in each U.S. state and ranks the states where residents pay off the debt the fastest and slowest.

Data is sourced from Bankrate (2024) who also used average monthly household income to calculate how long it takes to pay off balances.

How Long it Takes to Pay off Credit Card Balances in Each State

Households in Alaska and Washington D.C. are carrying more than $7,000 in credit card debt, the highest across the country. However, with average annual household incomes of $109,000 and $149,000, residents in both states can pay off their debt in about 14–20 months.

Richer state households—Connecticut, California, Washington—have higher costs of living and are carrying higher credit card balances. But they also manage to pay them off quickly with their larger incomes.

On the other hand, households in poorer states have below-average debt but it take closer to two years for them to pay it off.

This highlights the unequal debt burden across America. While the people living on the coasts have higher costs, they’re compensated by their incomes. However the South’s lower costs are not as evenly compensated.

And of course, compound interest is not a game played in favor of the borrower. Carrying the debt for longer periods of time accrues additional interest. Bankrate’s analysis points out that when making only minimum payments, it would take more than 17 years to pay it off the national average debt: $6,140.

In case that seems like a ludicrous amount of time, here’s a good reminder that most credit card interest compounds daily and not monthly.

Poway’s Corovan becomes employee-owned

Poway-based Corovan, the largest commercial mover in the western United States, announces its transition to an employee stock ownership plan (ESOP), solidifying its commitment to elevating clients’ expectations and enhancing its social responsibility. Established in 1948, Corovan has built a reputation for providing the industry’s most comprehensive suite of commercial moving, storage, logistics, furniture and tech services for customers of all sizes and industries.

This milestone marks a significant evolution in Corovan’s journey. With a rich history dating back to its founding by Richard T. Schmitz, the company initially focused on household moving services. By 1955, Corovan expanded its business as an agent for North American Van Lines. Schmitz’s acquisition of Corovan in 1974 set the stage for significant growth and expansion throughout California. In 1993, Schmitz’s sons, Bob, Bud and Tom, took over the business, emphasizing commercial moving services over residential ones.

Swiss pharma giant Roche acquires Poseida for $1.5 billion

Roche, a multinational healthcare company based in Switzerland, will acquire San Diego’s Poseida Therapeutics for $1.5 billion after a $220 million collaboration in 2022. Poseida employees will join Roche’s pharmaceuticals division to advance program development in allogeneic cell therapies, including existing CAR-T programs.

Del Mar’s Kura Oncology, Japanese pharma group in partnership

Kura Oncology is set to grow its biopharmaceutical impact on a global stage through a $1.16 billion collaboration with Japan’s pharma group Kyowa Kirin. The partnership will develop and commercialize Kura’s menin inhibitor, ziftomenib, to treat acute myeloid leukemia.

UC San Diego buys MOCA building for $15 million arts campus

Continuing its work to advance higher education and strengthen regional talent, UC San Diego purchased the former Museum of Contemporary Art (MOCA) and Santa Fe Depot building downtown. As a part of its efforts to boost its downtown presence following the Blue Line trolley extension, the university will develop the newly-purchased site into “The Depot,” a $15 million arts campus and cultural hub for local nonprofits, artists, and performers.

H.G. Fenton Company receive 28 Mark of Excellence Awards

H.G. Fenton Company received 28 Mark of Excellence Awards from the Southern California Rental Housing Association (SCRHA) at their annual awards ceremony held on Nov. 1, 2024, at Sycuan Casino Resort. Celebrating its 30th anniversary this year, the SCRHA Mark of Excellence Awards showcase exceptional achievements in the Southern California rental housing industry, recognizing communities and individuals who demonstrate excellence in customer service, innovation, and collaboration.

Lafayette owner CH Projects to build second hotel near Hotel Del

A little more than a year after unveiling the $31 million restoration of the Lafayette Hotel, San Diego’s CH Projects is tackling another ambitious hospitality project — a 31-room luxury hotel in Coronado, complete with an outdoor jungle and lagoon.

Located across the street from the iconic Hotel Del Coronado, the new Baby Grand hotel will take the place of La Avenida Inn, a tired, 1950s-era motel that has been torn down. A two-story hotel, which is currently under construction, will replace the motel and include multiple restaurants and bars, both indoors and outdoors.

San Diego Wave achieves No. 2 global ranking in

women’s soccer average attendance for 2024 season

Setting a new milestone in women’s professional soccer, San Diego Wave FC announced it achieved the #2 global ranking for average attendance during the 2024 season. The Wave drew an impressive average of 19,575 fans per match, underscoring the club’s role as a leader in the National Women’s Soccer League (NWSL) and a driving force in elevating women’s sports worldwide. In the 2024 NWSL season, San Diego Wave FC consistently led league attendance, hosting a total of over 215,000 fans at Snapdragon Stadium throughout the year. The club kicked off the season with a sold-out crowd of 32,066 fans at the club’s home opener, breaking its own NWSL home opener attendance record set in 2023.

From Adam Day, chief administrative offficer,

Sycuan Tribal Government | Administration:

As the Sycuan Band of the Kumeyaay Nation celebrates the 41st anniversary of our Sycuan Casino Resort, I wanted to take a moment and share our latest community video. Hopefully you enjoy hearing about the progress we have made for our reservation community. In addition, you will learn about the positive philanthropic and economic development impact we have had for our neighbors throughout San Diego County.

A link to our website is below with the newest video highlighted upfront – “Sycuan Overview” – as well as other community updates.

California’s employment safety net is still broken.

Will anyone fix it?

By Lauren Hepler | Calmatters

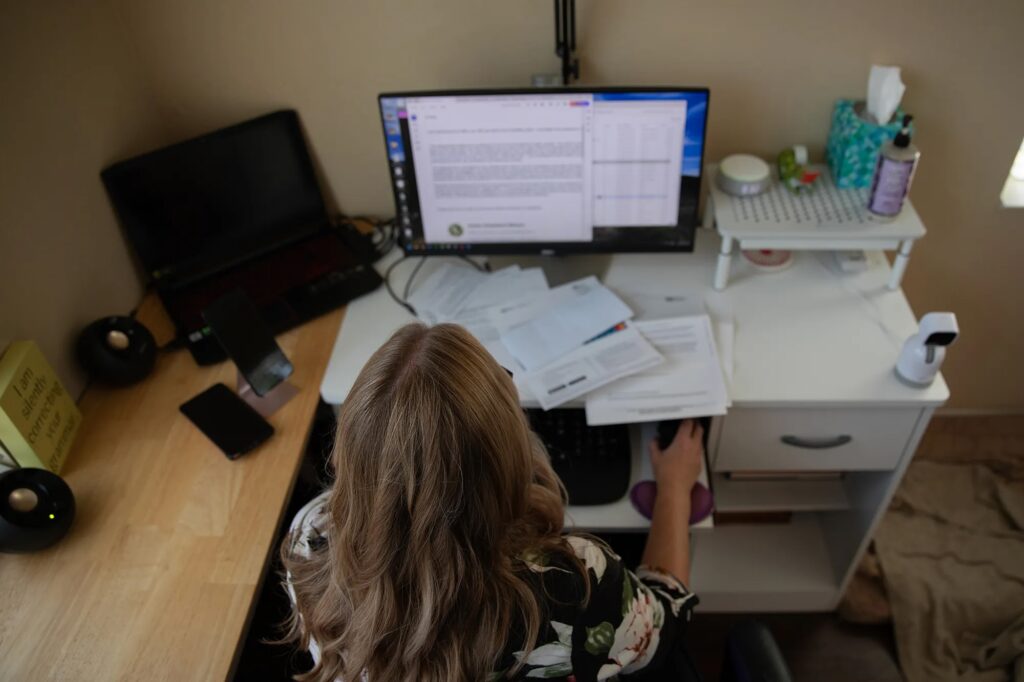

Kim Tanner didn’t expect to become a fraud detective when she filed for disability with the California Employment Development Department.

But in mid-July, $3,161 vanished from her online account with the state’s new debit card contractor, Money Network, according to Tanner’s complaints to government regulators. Someone had gotten access to her online debit card account, added a new bank account and transferred out her money, all without any notifications, she wrote in the complaints.

Tanner said Money Network told her it could take 90 days to investigate, and that she may or may not get a full refund, leaving her short on rent money. She turned to social media and saw similar horror stories on Reddit and Facebook. “My head exploded,” Tanner said. “This was happening to tons of people.”

So she started filing complaints. First with Money Network, its parent company Fiserv and the EDD. Then with a state senator and a half-dozen financial regulators.

“It just went on and on and on,” said Tanner, who got her money back via paper check about a month and a half later, after a federal agency intervened. “This needs to be investigated.”

A CalMatters investigation a year ago exposed how the EDD’s unemployment system crashed during the pandemic, the result of historic job losses, years of missed warning signs and poor contractor performance. As a result, the system at first failed to stop widespread fraud, then cut off access to millions of real people who used it as a crucial lifeline.

Now, even with a new payment contractor in place, concerns about fraud linger for people who rely on unemployment and disability programs run by the EDD. Multiple lawsuits and 74 federal consumer complaints about government debit cards have been filed by Californians against Money Network this year alone. The EDD and the company say the debit card fraud is smaller scale than the varied forms of fraud during the pandemic.

On top of the fraud complaints, a report released by the Legislative Analyst’s Office warns that lawmakers are failing to address a bigger unemployment problem: a “broken” financial model, one that threatens the whole system.

Read more