How The Biden Economy Could Be Fixed

By Andrew F. Puzder

Just about everybody on Wall Street knows, despite what you read in the financial press, that President Biden’s economic policies are driving our economy into a recessionary ditch. In a recent Wall Street Journal survey of 23 large financial institutions that do business directly with the Federal Reserve, 16 predicted a recession in 2023 and two predicted a recession in 2024, while only five predicted that we would avoid a recession—although even those five predicted we’d have only .5% economic growth, well below the 2.1% average over the past 20 years and dangerously close to what has traditionally been considered a recession.

A recession is defined as two consecutive quarters of negative economic growth. At least it was before the financial press redefined it prior to the 2022 midterms, ensuring that despite two consecutive quarters of negative growth, Biden’s policies couldn’t be labeled recessionary. But regardless of the definition, this negative growth meant declining standards of living, fewer job opportunities, lower wages, and increased poverty for the American people.

The hard economic times we are experiencing are especially striking as they come on the heels of the Trump boom, which opened our eyes again to American economic potential when we have low taxes, reduced regulation, and a bountiful supply of domestic energy. Everybody, particularly minority and low-wage earners, reaped the benefits in the Trump years of abundant job opportunities, increasing wages, historic highs in family income, and historic lows in rates of poverty and unemployment.

Consider some of the metrics. In 2019, the last year before the pandemic, median family income grew to nearly $73,000. It went up $4,600 in that year alone, a 6.4% increase over 2018—the largest annual increase going back to 1967. That amounted to 45% more growth in one year than the $3,200 increase that the Obama administration achieved in eight years. And contrary to what would become an election year talking point, the economic benefits were widespread. Every racial group experienced a record high median family income level: for white Americans it rose 5.7%; for black Americans, 7.9%; for Hispanic Americans, 7.1%; and for Asian Americans, 10.6%.

As incomes grew in 2019, the poverty rate plummeted 1.3 percentage points to a 60-year low of 10.5% — the lowest poverty rate since the government started reporting the statistic in 1959. This lifted 4.1 millionpeople out of poverty. For comparison purposes, during the eight years of the Obama administration, the number of people living in poverty increased by 787,000. And again, the decrease in the poverty rate under Trump disproportionately benefited minorities: the poverty rate decreased eight-tenths of a percentage point for whites, two percentage points for blacks, 1.8 for Hispanics, and 2.8 for Asians.

The year 2019 should be remembered as the year of the worker. And that wasn’t due to mandated wage increases, racial reparations, climate regulations, tax increases, or any other redistributionist policy. Working class Americans saw their circumstances materially improve in 2019 because of policies that encouraged economic freedom.

Turning the clock ahead, since March 2021, two months after Biden took office and began reversing Trump’s economic policies, the Consumer Price Index—the average in prices paid by consumers for goods and services, by which inflation is commonly measured—has surged. And it continues to surge. When representatives of the Biden administration say that inflation is coming down, they are playing word games. From month to month, inflation may be going up at a somewhat slower rate—that is, the rate at which inflation is increasing might be down from previous highs. But the increases are cumulative so the dollar impact of each monthly increase adds to the prior months’ increases.

It remains well above levels prior to the Biden presidency. The Federal Reserve aims to keep inflation around 2% — which is roughly where it was during the Trump administration. It is now at 6.4%, having at one point since 2021 hit nine percent.

It failed to act when inflation started to set in. Remember when everyone insisted that the inflation we were experiencing was “transitory”? It turned out to be anything but. For that reason, since last year, the Federal Reserve has increased interest rates at the fastest pace since the 1980s. It intends to continue raising rates because inflation has proven so persistent and widespread. And the longer these interest rate hikes continue, the more inevitable it becomes that we will suffer a deep recession.

This situation has not come about on its own. It was engineered. When the pandemic ended, all we needed to do to create dynamic economic growth again was to leave in place the policies we had before the pandemic. But of course, we didn’t.

Coming out of the pandemic, we knew two things. First, we knew people had accumulated a lot of money. The savings rate had surged in an unprecedented way during the pandemic, and when it was over this resulted in an increased demand for goods. This surge in the savings rate wasn’t a mystery: the federal government handed out $5 trillion during the pandemic, and people had very little opportunity to spend it since they weren’t traveling, eating out, going shopping, etc. So, in 2021, Americans had a lot of cash.

The second thing we knew coming out of the pandemic was that fewer people were working. If you tried to get anything done around your house back then, you will remember that. You couldn’t get anybody to do the work. Then, if you found someone, you couldn’t get the goods or materials you needed because they weren’t being produced.

Excess demand and low supply was the situation when Biden took office. And as any student of elementary economics knows, when demand exceeds supply you get inflation. Isn’t it pretty obvious what should be done in that situation? You should adopt policies that juice supply and avoid adopting policies that juice demand. Instead, the Biden administration proceeded to do the exact opposite.

Coming into office in January 2021, the Biden administration witnessed the beginnings of a dynamic recovery, and perhaps they thought it would continue no matter what they did—that Americans would flock back to work, spend money, travel, go back to restaurants, and so on. The administration and the Democrats in Congress saw it as a prime opportunity to enact legislation to remake America.

A New York Times Magazine headline following Biden’s inauguration read: “The Biden Team Wants to Transform the Economy. Really.” During the campaign, Biden himself said of his plans: “I truly think that if we do this right, we have an incredible opportunity to not just dig out of this crisis, but to fundamentally transform the country.” That’s how the Democrats saw the pandemic—as an opportunity for radical change. So, a little more than a month into the Biden presidency, on a totally partisan basis, the Democrats in Congress passed and Biden signed a $1.9 trillion spending bill they called “The American Rescue Plan.”

Talk about a misnomer! This so-called plan handed out more cash to American consumers, further increasing demand, and discouraging work, further decreasing supply. That this was economic suicide wasn’t only obvious to conservative free-market types like me. Larry Summers, who served as Secretary of the Treasury under President Clinton and as head of the Council of Economic Advisors under President Obama—a former president of Harvard and a well-respected liberal economist—called this the least responsible economic policy in 40 years. All you needed to understand this was a simple familiarity with the laws of supply and demand vis-à-vis inflation.

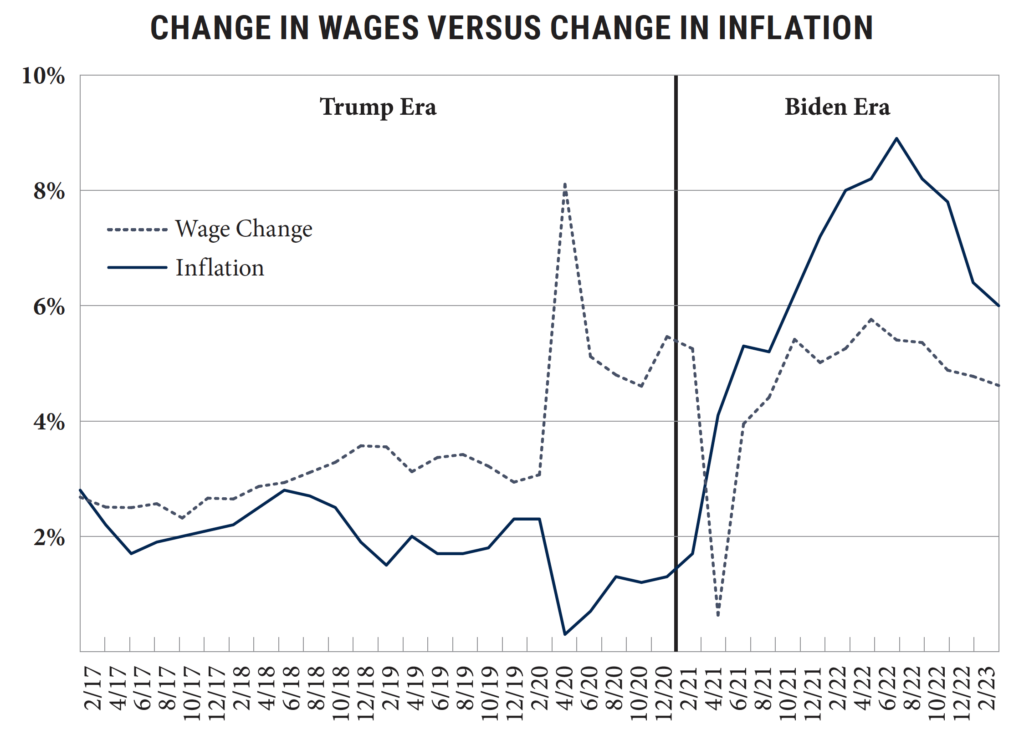

The negative impact on American workers has been tremendous. The chart above traces wages (or income) versus inflation as reflected in the Consumer Price Index. The dotted line is wage growth and the solid line is inflation. The big surge where the dotted line jumps way up reflects federal spending during the pandemic. To the left of that jump, we see that during the Trump administration, wages were up about three percent and inflation about two percent. To the right on the chart, we see what happened after Biden took office. Within a couple of months, inflation shoots way up above wages—indeed, the month inflation crossed over wages was March 2021, the very month Congress passed The American Rescue Plan.

Since so many people are not working and wages have been declining due to inflation, savings dropped to historic lows—to the lowest level we’ve seen going back to 1959. People are running out of cash, and as a result they are using credit cards. Credit card debt when Biden took office was at $748 billion and it stayed there until May 2021—again, until shortly after the passage of The American Rescue Plan—at which point it began to shoot way up to what is now $986 billion, the highest level of credit card debt in our history. And this is happening at a time when the Federal Reserve is compelled to continue raising interest rates to try to battle inflation.

Is there anything the Biden administration could do?

If the Biden administration wanted to lessen the misery and hasten recovery, it would do whatever it could to increase supply. And there are two areas where it could have a significant positive impact on the supply side: the cost of energy and the cost of labor.

Energy and labor impact virtually everything in our economy. Thousands of products have a petroleum component, and even those that don’t have to be delivered, which requires oil and gas. And you can’t build, manufacture, deliver, or install anything without labor—labor affects the price of everything. So, if your goal were to fight inflation, you would implement policies to drive down energy and labor costs.

This is elementary. It’s simple. The problem is ideological. Here’s Biden responding to a young person during the 2020 campaign: “Kiddo,” he said, “I want you to just take a look. Okay? You don’t have to agree, but I want you to look in my eyes. I guarantee, I guarantee we’re going to end fossil fuel.” And this wasn’t one of Biden’s all-too-common gaffes. At a rally in February 2020, his prepared remarks contained the same pledge. And he has advanced this goal as president by, among other things, killing oil pipeline projects, failing to grant oil leases, failing to approve drilling permits, and limiting the ability of energy companies to obtain financing. He has done everything in his power to reduce America’s domestic energy production, cripple our energy sector, and increase our dependence on expensive foreign oil.

The cost of labor has also continued to surge. The increase in wages that Biden crows about is normally a good thing. But it makes no economic sense to ignore the impact of inflation on the value of wages. It is simply a fact that workers are better off if inflation is up 2% and their wages are up 3% than if inflation is up 6% and their wages are up 5%. They are making more money in the second case, but the money is worth less.

Why are labor costs surging? Because employers can’t find workers. Two years after the pandemic ended, there are still 2.8 million workers missing from the labor force. Why? A recent study headed by University of Chicago economist Casey Mulligan found that in 24 states, unemployment benefits and Obamacare subsidies for a family of four with no one working are equal to or above national median household income. In three of those states, a family of four with no one working can receive over $100,000 per year in cash and benefits. In 14 states, that number is at least $80,000, which is more than the average salary for a construction worker or an electrician. In other words, two years after the pandemic, we’re still paying people not to work at a time when businesses and our economy desperately need workers.

In the Trump economy, increased wages resulted from businesses competing with other businesses for workers. Today, increased wages are the result of businesses competing with government benefits. If increasing people’s dependence on government is your goal, this is a great approach. It is a dreadful approach if your goal is bringing inflation to heel and sparking a dynamic economic recovery.

To address inflation and avoid a deep recession, Biden should tell American bankers, asset managers, bureaucrats, and environmentalists to get out of the way of the energy industry because America needs oil now. Second, he should work with Congress to reduce or eliminate the work-discouraging programs that are keeping able-bodied Americans out of the workforce. We should not cut programs for those who need assistance, but we should reduce benefits for those who are able to work but are choosing not to work. With abundant energy and a vibrant workforce, we could make significant headway against inflation and quickly improve the lives of the American people.

The problem isn’t that the policymakers in the Biden administration don’t understand the basic principles of economics. The problem is that they have different goals than most Americans.

When Biden spoke during the campaign about transforming America, he meant it. The current policy is not the goal of creating widespread prosperity by means of a dynamic and productive economy. The goal is the transformation of America’s economy and our way of life in accordance with a Leftist political agenda, using so-called emergencies like climate change as a rationale. The Biden administration is not going to take the simple measures needed to increase American energy production and get people back in the workforce, because that’s not in line with their goals.

Americans need to open their eyes to the fact that our elected leaders across the political spectrum understand clearly what policies will lead to prosperity and freedom for the American people, but that only some of those leaders consider prosperity and freedom the goal. We need more of them.

The following is adapted from a talk delivered on February 22, 2023, at a Hillsdale College National Leadership Seminar in Indian Wells, California.