Daily Business Report-Sept. 27, 2019

Bunker Labs San Diego Team

Bunker Labs officially launches San Diego

chapter with West Region Muster

Bunker Labs, a national nonprofit helping veteran entrepreneurs, will celebrate the official opening of the San Diego chapter with a ribbon cutting ceremony and reception on Oct.17 at the West Region Muster. The event is at Moniker Warehouse, 705 16th St. in East Village, 4:30 to 9:30 p.m.

Bunker Labs seeks to inspire veterans and veteran spouses to start their own business by providing them proper training, resources, and connections. The San Diego chapter is the 29th chapter nationwide and the third in California after Bunker Labs-Bay Area and Bunker Labs-Los Angeles. Bunker Labs is on track to have a chapter in every state by 2021.

“San Diego is the next natural expansion for Bunker Labs,” said Bunker Labs CEO, Todd Connor. “San Diego has a strong veteran population, great entrepreneurial prowess and a supportive community. We know that we can foster this great environment to help the veteran community here thrive.”

The San Diego Launch event is just one of the events of the West Region Muster. The Muster is open to the public and will include speakers, breakout sessions, networking, a pitch competition sponsored by the Ford Fund featuring some of San Diego’s veteran entrepreneurs from the WeWork Veterans in Residence Program powered by Bunker Labs.

To attend the Bunker Labs West Region Muster, find more information here.

To stay in the loop for upcoming events, check out the schedule and join the Bunker Labs San Diego mailing list here.

_______________________

Redesigned helicopter gunner seats

delivered to Naval Station North Island

The Aircrew Systems Program Office delivered, installed and demonstrated the first two redesigned MH-60S Seahawk gunner seats on Sept. 24 and 25 to Helicopter Sea Combat Wing Pacific at Naval Air Station North Island.

The original MH-60S Gunner Seat was notoriously uncomfortable for aircrew to sit in for any length of time, and became detrimental to aircrew long-term health. Fielding a replacement is naval aviation’s No. 2 safety priority.

“The MH-60S Gunner Seat is proof that the fleet and NAVAIR listen to one of our most precious assets—the naval aircrew. Its redesign focused on the health of the aircrew, providing better crash protection and improving endurance,” said Capt. Ryan T. Carron, commodore, commander of Helicopter Sea Combat Wing Pacific at Naval Air Station North Island.

_______________________

Treasurer-Tax Collector hits

1 million property tax bill record

For the first time, the San Diego County Treasurer-Tax Collector’s Office is mailing over 1 million property tax bills to local property owners.

San Diego County is now home to 1,001,029 separate parcels, Treasurer-Tax Collector Dan McAllister announced, and in the coming week, their owners will receive the 2019-2020 tax bills. The bills are expected to yield $6.9 billion.

“Despite the need for more housing that we hear about on a regular basis, I see this record-high parcel number as a positive sign,” said McAllister. “It means new units are coming on the market, and we expect that number to grow as legislators encourage more homebuilding in our region.”

The total amount owed by property taxpayers is $482 million more than last year’s total of $6.42 billion. Rising home prices and new residential units are contributing to the increase.

“The number of parcels in San Diego County grew by 2,731. The majority of that increase was due to new condos, but we did see a rise in single family homes as well,” said McAllister.

Property owners do not need to wait for the physical bills to hit their mailboxes. Their digital bills are available now at sdttc.com. McAllister recommends going online to pay property taxes with an e-check (electronic check), which is completely free. Paying online also provides taxpayers with an emailed receipt as confirmation of their payment, and sdttc.com is secure to use with no history of data breaches.

The first property tax installment is due on November 1, 2019, and becomes delinquent after December 10, 2019. The second installment is due February 1, 2020, and becomes delinquent after April 10, 2020.

Property owners who have not received their tax bill by October 31, 2019, should get their bill online or call the Treasurer-Tax Collector’s Office toll free at 877-829-4732.

_______________________

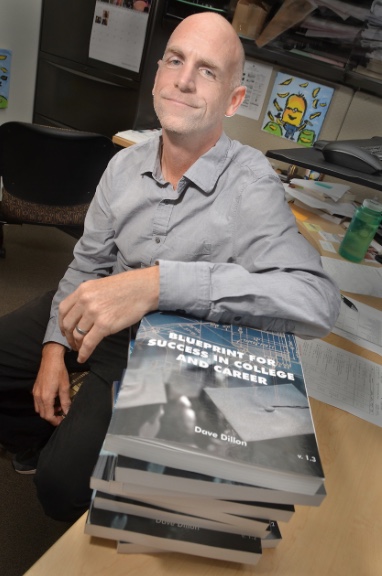

Grossmont College instructor wins

international award for open-access textbook

Grossmont College Counselor and Professor Dave Dillon whose open-education textbook won a national textbook excellence award in Philadelphia in June has garnered global recognition.

The international, nonprofit Open Education Consortium has selected “Blueprint for Success in College and Career” for an Open Education Award for Excellence. Its 17 winners represent 10 countries from North and South America, Latin America, the European Union and Asia.

“Blueprint for Success” is one of three OER textbooks that Dillon succeeded in getting published that are used by more than a dozen community colleges in and out of the state. They are openly licensed works that he compiled to use in his counseling classes.

“Blueprint for Success in College and Career” is the first OER textbook awarded the prestigious Textbook Excellence Award by the national Textbook and Academic Authors Association, an achievement that brought the book to the attention of the international Open Education Consortium.

The Consortium annually presents Awards for Excellence for Open Resources Tools and Practices and selected Dillon’s book in the Open Textbook category.

The winners are invited to receive their awards at the Open Education Global Conference Nov. 26-28 at Politecnico di Milano, a scientific-technological university in Milan, Italy.

_______________________

CBP selects Citadel Defense anti-drone

system to protect southern border

U.S. Customs and Border Protection and Darley Defense have awarded Citadel Defense a contract for over $1 million to protect areas along the southern border in Texas, Arizona, and California from drones posing a threat to national security. Drones are being used by the cartel to transport illegal contraband and help migrants illegally cross the border. CBP will use Citadel’s counter drone technology to prevent these drones from compromising border security, the customs agency said.

“Drones have become a greater challenge along the border. Our nation’s border agents deserve the safest and most advanced technology available,” said Citadel CEO Christopher Williams. “Citadel’s automated solution provides front-line operators with awareness of drone threats and decision-making to respond faster than the adversary.”

_______________________

La Jolla Band of Luiseño Indians receives

$9.5 million federal grant to renovate campground

The U.S. Commerce Department’s Economic Development Administration (EDA) is awarding a $9.5 million grant to the La Jolla Band of Luiseño Indians of Pauma Valley to renovate the tribe’s campground and upgrade it to improve its resiliency to future flooding events.

The project will include the demolition of two existing, flood damaged buildings, improvements to parking and roads to make them flood resistant, along with the construction of a new building, replacement of an existing septic system, and site storm drains, domestic water lines and other utilities. An emergency look-out tower will also be built.

The project is funded under the Bipartisan Budget Act of 2018.

_______________________

Proposition 13 works and remains popular.

So why are special interests attacking it?

By Rob Lapsley and Allan Zaremberg | Special to CalMatters

Backers of an initiative to eliminate Proposition 13’s protections for some groups finally acknowledged something we have known all along: the measure is fatally flawed, would be bad for California and would shortchange school districts contrary to the stated purpose of the initiative.

This admission came after they spent millions of dollars to place the “split-roll” measure on the November 2020 ballot.

Now, they’ve decided to scrap that measure, write a second draft, and attempt to qualify it for the 2020 ballot.

The real question is why not withdraw the old, flawed ballot measure now? Do they really plan to present voters with an admittedly flawed constitutional amendment if they can’t replace it with their new measure?

Sadly, the answer is yes.

A split-roll initiative would remove Proposition 13’s protections for commercial and industrial property and raise their property taxes by billions of dollars a year. Businesses would have no choice but to pass those increased costs onto you and me, raising the prices on everything we buy, from gasoline to groceries, while also raising our utility and healthcare bills.

Unfortunately, these special interests are so intent on destroying Proposition 13 that they’ll leave the first poorly written measure on the ballot as a backup just in case they can’t qualify the new measure.

This is the clearest evidence yet that those behind the split-roll measure aren’t concerned with what’s best for Californians. They’re focused on raising taxes at any cost, even through a terribly flawed measure.

If the old measure is pulled from the ballot and replaced with this second draft, it still would be the largest property tax increase in state history and the most direct attack on Proposition 13 in a decade.

Public polling consistently shows that the split-roll property tax fails to earn even 50 percent support.

A June 2018 survey by the Public Policy Institute of California (PPIC) showed just 46 percent of respondents support the tax. This is the lowest level of support for a split roll tested by PPIC since 2012.

In contrast, Proposition 13 continues to remain popular with voters. The same PPIC poll showed 65 percent of voters believe Proposition 13 was good for California. That’s the same percentage that passed the measure 41 years ago.

Proposition 13 was passed by nearly two-thirds of California voters in 1978 because our property tax system was out of control.

The initiative stopped skyrocketing property tax bills by capping annual increases in property taxes at 2 percent per year. It also calculates general property taxes based on 1 percent of the purchase price rather than market value, protecting property owners and local governments from drastic booms and busts in the real estate market.

Proposition 13 creates stability for homeowners, renters and businesses, ensuring they won’t be broadsided with dramatic property tax increases. It also creates a reliable tax revenue stream that has grown on average 7 percent a year since the passage of Proposition 13, and is projected to reach an all-time high of $74 billion.

The pros and cons of a split roll will be argued before the voters next year. We’ll work hard to educate voters about why they should reject this attempt to gut Proposition 13.—

Rob Lapsley is president of the California Business Roundtable, Rlapsley@cbrt.org. Allan Zaremberg is president and chief executive officer of the California Chamber of Commerce, az@calchamber.com. They are co-chairs of the Californians to Stop Higher Property Taxes. They wrote this commentary for CalMatters, a public interest journalism venture committed to explaining how California’s Capitol works and why it matters.