Daily Business Report-Aug. 21, 2018

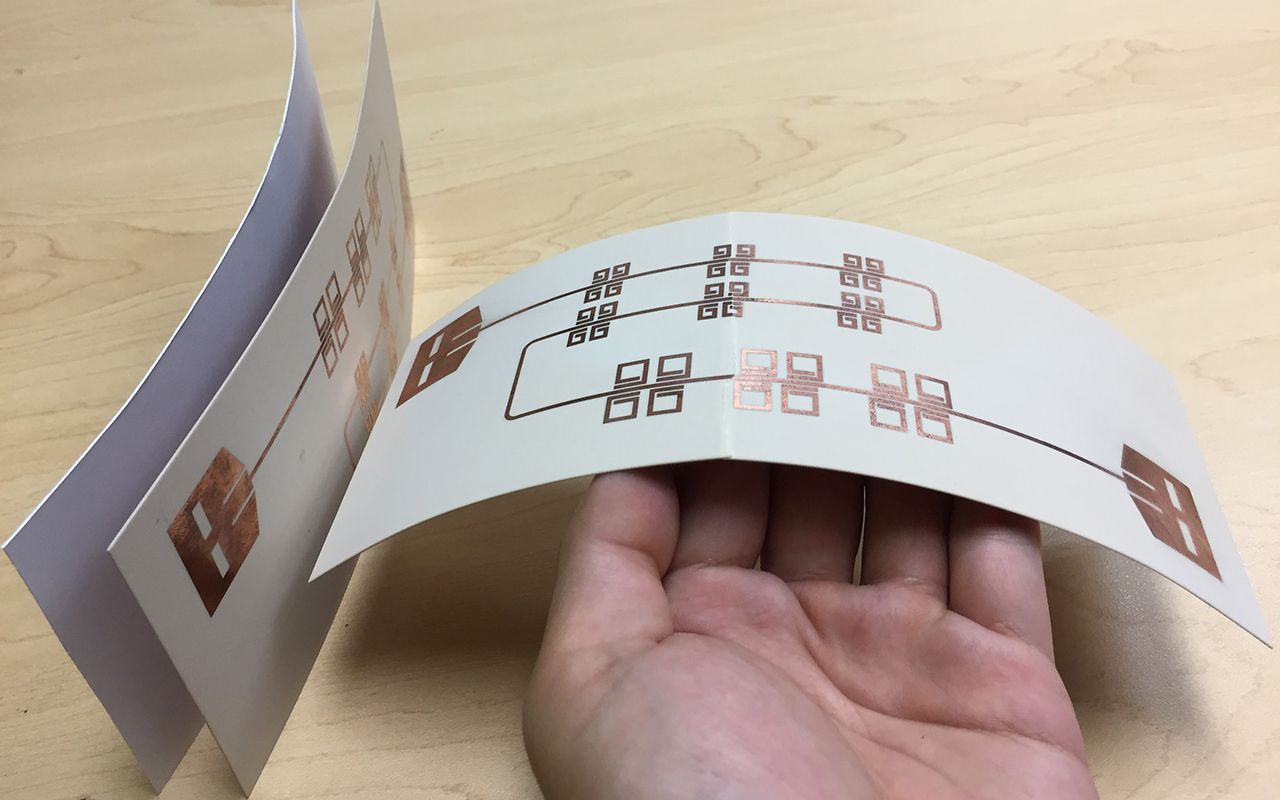

Printed thin, flexible LiveTag tags in comparison with a piece of photo paper (far left). (Photo courtesy of Xinyu Zhang)

These tags turn everyday objects

into smart, connected devices

By Liezel Labios | UC San Diego News Center

Engineers have developed printable metal tags that could be attached to everyday objects and turn them into “smart” Internet of Things devices.

The metal tags are made from patterns of copper foil printed onto thin, flexible, paper-like substrates and are made to reflect WiFi signals. The tags work essentially like “mirrors” that reflect radio signals from a WiFi router. When a user’s finger touches these mirrors, it disturbs the reflected WiFi signals in such a way that can be remotely sensed by a WiFi receiver, like a smartphone.

The tags can be tacked onto plain objects that people touch and interact with every day, like water bottles, walls or doors. These plain objects then essentially become smart, connected devices that can signal a WiFi device whenever a user interacts with them. The tags can also be fashioned into thin keypads or smart home control panels that can be used to remotely operate WiFi-connected speakers, smart lights and other Internet of Things appliances.

“Our vision is to expand the Internet of Things to go beyond just connecting smartphones, smartwatches and other high-end devices,” said senior author Xinyu Zhang, a professor of electrical and computer engineering at the UC San Diego Jacobs School of Engineering and member of the Center for Wireless Communications at UC San Diego. “We’re developing low-cost, battery-free, chipless, printable sensors that can include everyday objects as part of the Internet of Things.”

_______________________

Online auction starts Aug. 27

on Coleman University assets

Heritage Global Partners will manage the global online auction of the complete campus assets of Coleman University in San Diego, beginning on Aug. 27. Founded in 1963, Coleman focused on information technology undergraduate and graduate programs. The Uuniversity is closing its doors after serving students for 55 years.

To register for the event and/or access the complete sale catalog with photos, lot descriptions and other information, click here

http://www.hgpauction.com/auctions/95601/coleman-university/

Coleman learned in late June that it had lost a bid for accreditation from the Western Association of Colleges and Universities Senior College and University Commission, putting the school in a financial bind.

“Declining enrollment over the last five years has taken its toll,” said university President and CEO Norbert Kubilus. “ Many factors outside of the University’s control contributed to this decline, such as de-recognition of our national accreditor by the Secretary of Education, tightened controls over international students coming to the United States to study, and historically low unemployment in our region.”

_______________________

San Diego involved in

pilot program on drones

Aviation Today

One of the country’s 10 participants in the nationwide drone integration pilot program (IPP) was launched recently in San Diego. To kick it off, the San Diego Fire Department responded to a simulation fire call in concert with drones equipped with aerial telepresence software provided by Cape.

The Department of Transportation’s IPP is comprised of public-private partnerships intended to study the safe integration of UAS into the national airspace. In San Diego, the focus is on food and medicine delivery, border protection and public safety, with partners including Cape, Intel, Uber, AT&T, the city of Chula Vista and some local schools.

At the fire call demonstration, the Cape-equipped drone arrived at the scene of the “fire” in about a minute. With the help of its eye-in-the-sky guidance, firefighters were able to locate the incident more quickly after the firetruck arrived about four minutes later. They had had eyes on the scene via an iPad while the truck was still en route.

_______________________

Quest for safer pain meds

garners $3.6 million grant

The National Institute on Drug Abuse, part of the National Institutes of Health, has awarded a five-year, $3.68 million grant to two Scripps Research scientists, Laura Bohn and Thomas Bannister, to advance their work developing safer pain medications.

Previously, Bohn and Bannister, based in Jupiter, Fla., had developed new compounds that separate the powerful pain-relieving benefit of opioids from the life-threatening side-effect of decreased breathing rate and lower blood-oxygen levels. The new round of funding enables the team to further improve these compounds while also evaluating the extent to which other common opioid side effects, including constipation, drug tolerance, and especially addiction risk, are inherently altered in these new compounds, with an eye toward further widening the safety margins.

_______________________

San Diego Women’s Foundation

announces grants availability

The San Diego Women’s Foundation announced the availability of grant funding for Human Trafficking: Prevention & Intervention. The 2019 grant cycle aims to support organizations that work to combat and prevent human trafficking in San Diego County.

To be considered, eligible nonprofit organizations must send a Letter of Inquiry by Sept. 10 at 5:p.m. for projects with a minimum proposal of $25,000 that work across various fields to provide services to those at risk or affected by human trafficking, including, but not limited to, one or more of the following:

• Education for prevention

• Rescue programs

• Therapy and/or counseling

• Life skills training

• Employment education

• Housing solutions

• Victim advocacy

• Healthcare

• Food access

• Legal services

• Social services

For more information about the grants cycle, or to apply for one of the available grants, visit https://www.sdwomensfoundation.org.

_______________________

General Atomics wins $133.97 million

contract from Missile Defense Agency

General Atomics Electromagnetic Systems San Diego has been awarded a $133.97 million contract to complete the development, integration, and flight test of an advanced sensor into an MQ-9 unmanned aerial vehicle in realistic test scenarios at continental U.S. and outside the continental U.S. locations. The work will be performed in San Diego.The Missile Defense Agency, Albuquerque, N.M., the contracting agency.

The performance period is from August 2018 through October 2021.

_______________________

USD to establish institute

for mental health ministries

The University of San Diego School of Leadership and Education Sciences has received a grant from Deacon Ed and Ruth Schoener of Scranton, Pa., to establish the Catholic Institute for Mental Health Ministry (CIMHM). The CIMHM will directly support the implementation of Mental Health Ministries in Catholic Dioceses, parishes and other Catholic organizations such as schools, colleges and hospitals.

The goals of the CIMHM will be to assist participating Catholic faith communities in reducing the stigma associated with mental illness through the support provided by trained ministry leaders. Grantees will be trained at USD in Mental Health First Aid and mental health ministry programs.

_______________________

Personnel Announcements

Mickey Welcher and Dan Malott join Shoreline Partners

Shoreline Partners announced the addition of Managing Directors Mickey Welcher and Dan Malott. Together, they expand the firm’s services to include capital raising and its reach into the Upper Midwest markets as well as the aviation, tech, biotech and medical device industries.

Welcher will focus on assisting tech, medical device and life sciences companies looking to raise capital. He has spent more than 30 years in the investment industry, focusing on researching, valuing and investing in companies. Before joining Shoreline, Welcher founded and was president of Envestim, a boutique advisory firm that developed an online investing platform based on Welcher’s experience. He graduated from Arizona State University with a bachelor’s of science degree in business administration.

Malott brings more than 20 years of aviation and business experience to the Shoreline team. After several years in the industry as a United Express airline pilot and Cirrus Design factory instructor, he accepted a position as an assistant professor at the University of North Dakota and received academic tenure in 2011. In 2010 Malott co-founded Valley Medflight, a regional air ambulance company based in Grand Forks. The company grew to five bases in only two years, flying 6 Pilatus PC-12 aircraft with more than 40 full-time employees. He and his two partners successfully sold the company to a large national operator in 2013.

_______________________

Ashley Otte joins San Diego Legion

San Diego Legion, a Major League Rugby franchise, announced the appointment of Ashley Otte as executive general manager effective Aug. 27. In his new role, Otte is responsible for management of the Legion’s overall business, including its relationships within Major League Rugby, the media, and Legion fans, sponsors, and partners.

Prior to his current role, Otte served as the general manager at The Enthusiast Network (TEN Media), specifically Powder Magazine group where he was responsible for the strategic direction of the collective business including development, marketing, sales, events and content initiatives. During his tenure at TEN, Otte curated and executed a growth strategy for all business ventures creating year-on-year growth.

Founded in 2018, San Diego Legion is part of the professional Major League Rugby organization, one of eight founding teams launching in the U.S.

_______________________

Gary Grinberg and Alfred Moret join Beta Wealth Group

Beta Wealth Group, a San Diego-based wealth management firm, is expanding services to clients in the North County coastal corridor with the addition of two executive wealth managers — Gary Grinberg and Alfred Moret — to its Cardiff office team at 2177 San Elijo Ave., Cardiff-by-the-Sea.

Gary Grinberg earned a B.S. in finance from San Diego State University and has been serving clients as a financial adviser since 1985. He started his career with EF Hutton and left its successor, Morgan Stanley, in 2013 to become a principal in a new firm. Gary’s specialty is executing personalized, long-term strategies that align with the financial objectives of his clients.

Alfred Moret has over 30 years of financial planning leadership and extensive experience working with high net worth investors. After graduating from San Diego State University with a B.S. in finance, he started his 30-year career with Dean Witter/Morgan Stanley as an account executive. During his tenure, Alfred was promoted to associate vice president, vice president and then branch manager before retiring from the firm in 2008.

_______________________

Legislature has been snuffing out

bills that aim to help insured

homeowners in wildfire country

By Antoinette Siu | CALmatters

Jen Burt lives with her husband and two kids in the woods not far from Grass Valley, in a four-bedroom foothill house in a stand of black oak and cedar trees. Tucked away on a private road, the five-acre spread is a hallmark California dream—and a potential California nightmare: It’s in wildfire country. Last February, Burt’s insurer of six years canceled her fire insurance. The scramble for new coverage was pricey and harrowing.

Now, like a lot of rural homeowners, Burt is hoping for a solution in the form of wildfire legislation. Of the more than 13.6 million homes in the state, about a third are in or near areas vulnerable to wildfire, and many homeowners are having trouble finding or keeping their fire insurance.

But of all the constituencies—from utility companies to first responders—clamoring for state help as firenados ravage California and legislators rush toward the Aug. 31 end of session, homeowners who live in fire-prone areas and fear losing coverage seem among the least likely to get legislative relief.

The “new normal” of climate change-fueled natural disaster has also changed California’s policy landscape. Survivors of last year’s wine country fires want major upgrades in emergency communications. Utility companies, which by law are responsible for fires in areas where their lines run, have lobbied hard for a break on their fire liability.

Lawmakers have been working hard to address those issues, with varying degrees of success and deals in varying stages. But an ambitious package of consumer protections proposed by the Department of Insurance earlier this year that would make it harder for insurers to raise rates or cancel coverage in high-risk areas has mostly been quashed or sidelined. As key lawmakers continued working over the weekend, among the possibilities they discussed: creating some sort of fund to help fire victims, modeled on the protections afforded to homeowners living in flood zones. How to fund that, however, remains an open question.

The insurance industry, meanwhile, insists California is a big market and that insurers can still spread their risk enough to remain in it.

But soaring claims do drive up premiums, said Armand Feliciano, vice president of government relations at Property Casualty Insurers Association of America, a trade association representing about 1,000 insurance companies. “If you live in a very dry area,” said Feliciano, “it’s going to be very tough to spread that risk.”

Also, views are mixed on how to handle development in fire-prone regions. In Nevada County, where Burt resides, 70 percent of some 50,200 homes are at high risk of fires, according to the state Insurance Department.

Some note that high premiums and policy cancellations send market signals that deter people from settling in wildfire country. Others argue that by the time homeowners notice the price of insurance, they’ve already made a home, and the state has a responsibility to protect them. And, they add, it is only in recent years that fire danger has spiked.

In the Legislature, that debate has continued, even as the largest fire in state history, the Ranch Fire, blackened a swath of Mendocino, Lake and Colusa counties the size of Los Angeles. So far, insurers have largely prevailed.

Of the 10 or so bills originally proposed (some have been combined), six have died or stalled, including measures that would have expedited fire victims’ claims, advanced payment, helped curb rogue adjusters and let those who have suffered a total loss rebuild at a different location.

The few bills that remain have been substantially watered down from a consumer standpoint, says California Insurance Commissioner Dave Jones.

“Most of those bills were hijacked by the insurance industry one way or another, substantially and hostilely amended,” Jones said. “It was very disappointing, notwithstanding California’s worst wildfire, that the Legislature was not willing to pass strong consumer protection bills but instead allowed the insurance industry to water down or outright kill those bills.”

Among the remaining measures is SB 894, authored by Sen. Bill Dodd, a Napa Democrat whose district was ravaged by last year’s Wine Country fires. Dodd’s bill would make it easier for homeowners to get coverage to rebuild, give them more time to claim living expenses after a disaster and extend policy renewal protections.

That bill, inspired by homeowners who discovered they were underinsured after last year’s fires, is bound for the Assembly floor after a tough fight in which its reach was narrowed by insurers. Dodd complained that lawmakers too readily buy insurers’ argument that any fire insurance legislation will increase costs for consumers. “It’s like a license to kill the bill,” Dodd said. “The insurance lobby in this building is incredibly strong with its influence on members and staff.”

Assemblyman Marc Levine, a Greenbrae Democrat, also advanced two fire bills involving red tape issues. Passed in July, AB 1799 dealt with a chronic problem for disaster victims: the difficulty after a loss of simply getting a copy of complete policy documentation from insurers. AB 1797, awaiting a signature from the governor, would require insurance companies to provide a homeowner with rebuilding cost estimates every other year.

And SB 824 from Bell Gardens Democratic Sen. Ricardo Lara, who is running to succeed Jones as insurance commissioner in November, aims to prevent insurers from dropping or not renewing homes after a disaster. It would ensure that homeowners get their policies renewed the year following a declaration of emergency in their area, and would require insurance companies to submit fire loss data to the state. The bill is up for a floor vote in the Assembly after initial opposition from the Property Casualty Insurers.

Mark Sektnan, the group’s vice president of state affairs, said insurers feared the initial mandates “would have a chilling effect on the entire market,” but backed off after the bill added some exceptions, such as allowing insurers to cancel in the case of fraud.

Renewal, however, remains a worry. Besides consumers’ desire for coverage, fire insurance is a prerequisite for home mortgages.

From 2015 to 2016, the number of policy non-renewals went from 8,796 to 10,151 across all the counties, according to the Department of Insurance.

Meanwhile, in the wildland areas seen as at-risk of wildfires, policies purchased through the California Fair Access to Insurance Requirements Plan, an insurer of last resort for California homeowners, rose by about 8,000 between 2014 and 2017. Statewide, they total 30,432 policies—and although that may seem like a small number compared to the millions of homes insured by traditional carriers like AAA and Farmers, Jones calls them “the canary in the coal mine.” He said his office is fielding more homeowner complaints in high-risk areas about policy renewals, cancellations or premium increases.

“We’re not in a crisis yet, but you can see where this problem is going to accelerate. California climate is changing for the worse, and the world is not doing anything fast enough to change the greenhouse gases to de-accelerate the temperature rise,” Jones said.

In Grass Valley, the Burts eventually found insurance after more than a month of looking. Jen Burt said their coverage with AAA is a bit more expensive than their previous policy with Grange, but other carriers would have doubled their premium.

And like so many Californians, they’re not leaving.

“This is our forever home,” she said. “We don’t plan to move from here.”

CALmatters.org is a nonprofit, nonpartisan media venture explaining California’s policies and politics.