The Janus Ruling and Gov’t Unions

U.S. Supreme Court (Credit: Cool Photos)

How Government Unions

will Attack the Janus Ruling

By Edward Ring

On June 27, the U.S. Supreme Court issued their decision in the landmark case Janus vs. AFSCME, ruling that public sector unions can no longer force public employees to pay union dues. Janus argued that even so-called “agency fees,” which unions claim are only for collective bargaining and are therefore non-political, are, in fact, inherently political. As a result, Janus argued that mandatory collection of agency fees violated his first amendment right to free speech.

The court agreed, writing “union speech covers critically important and public matters such as the State’s budget crisis, taxes, and collective bargaining issues related to education, child welfare, healthcare, and minority rights.” We might add that public sector collective bargaining also affects work rules, hirings, terminations and promotions, ‘non-political’ lobbying, get-out-the-vote efforts, funding for educational public relations and academic studies; the list goes on.

Public sector union spending is indeed inherently political, and it is also intensely partisan, overwhelmingly supporting the party of bigger government.

While it was generally expected that the court would rule in favor of the plaintiff, Mark Janus, it was uncertain whether the scope of the ruling would extend to mandating opt-in vs. opt-out. Currently, for that portion of government union dues that are declared by the union to be used for explicitly political purposes – roughly 20 percent to 30 percent – members have to go through a laborious and intimidating “opt-out” process. Even as Janus extends that opt-out right to cover all dues, including agency fees, it can still be very difficult for public employees to stop paying these unions.

As it turns out, the court’s decision takes the further step of requiring public employees to opt-in to paying union dues. The court writes “Accordingly, neither an agency fee nor any other form of payment to a public-sector union may be deducted from an employee, nor may any other attempt be made to collect such a payment, unless the employee affirmatively consents to pay.” That is, instead of employees having to ask the union to stop withholding dues, now the union has to ask the employee to start withholding dues.

This is a major enhancement to the scope of the Janus decision, but government unions are working to minimize its impact.

How the Unions will use Contracts to get Employees to Waive their “Opt-In” Rights

A critical variable, not clearly addressed in the Janus decision, is when, and how often, an employee must “affirmatively consent to pay.” Related to this, and also requiring expert legal interpretation, is how requiring an employee to “affirmatively consent to pay” may conflict with contract law. What if the employee waives that right when signing an employment agreement? What if that waiver is buried in a more general employment agreement? Is that enforceable?

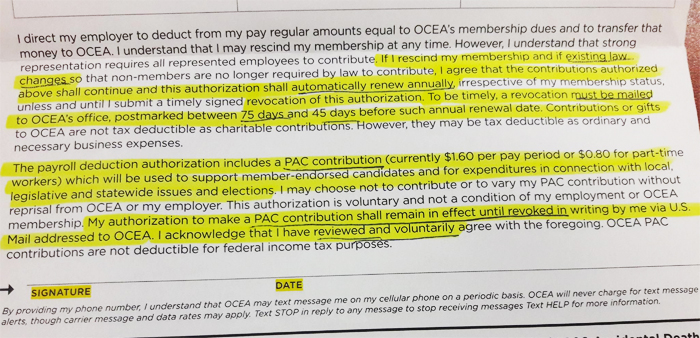

Take a look at this actual example of an actual recent agreement between an employee and their government union:

As can be seen, this contract has been modified to read “if I rescind my membership and if existing law changes so that non-members are no longer required by law to contribute, I agree that the contributions authorized above shall continue and this authorization shall automatically renew annually, irrespective of my membership status, unless and until I submit a timely signed revocation of this authorization. To be timely, a revocation must be mailed to OCEA’s office, postmarked between 75 and 45 days before such annual renewal date.”

Has an employee who signs this form, likely along with countless other forms they’ll sign on the first days of their initial employment, from then on permanently waived their right to only opt-in to dues payments? If you opt-in one time, are you stuck having to opt-out from then on? Every year?

To ensure that contracts such as the one featured here are signed, California’s union compliant legislature offers SB 285 and AB-2017, bills that make it difficult, if not impossible, for employers – or anyone else – to discuss the pros and cons of unionization with employees. These bills also refer any alleged violations to the union-packed Public Employment Relations Board instead of the courts.

Then to make the contractually mandated, Janus altering, opt-out process even more difficult, AB 1937 and AB-2049 prohibit local government agencies from unilaterally honoring employee requests to stop paying union dues.

There is an even more fundamental way the unions will try to obliterate the impact of the Janus ruling.

Unions May Attempt to Force State and Local Governments to Directly Fund Unions

Some government union advocates have already begun legal research into removing government union funding from any direct relationship to individual government employees. In an 6/27 article on Vox titled “How Democratic lawmakers should help unions reeling from the Janus decision,” the author argues that since unions only extract around 2 percent of wages, and since studies show that unionization confers a 17 percent better wage and benefit package, the employer should simply turn over 2 percent of total wages to the unions, rather than deduct 2 percent from individual paychecks. They write: “But if public employers simply paid the 2 percent directly to the unions – giving the same 15 percent raise to employees but not channeling the extra 2 percent through employee paychecks – then there would be no possible claim that employees were being compelled to do anything, and thus no constitutional problem.”

An article published in Slate makes a similar argument. The authors write: “States can replace their fair-share fee laws with provisions that require or allow public sector employers to subsidize unions directly.” They even claim that such a measure would reduce employee’s tax liabilities since their taxable income would be cut by 2 percent in order to fund the state’s direct union contribution in a “revenue neutral” manner. To support their argument for this “direct payment alternative” the authors cite a law review articlepublished in 2015 by law professors Aaron Tang of UC Davis, and Benjamin Sachs of Harvard.

The political power of public sector unions in California and other blue states is almost impossible to overstate. Returning governance to elected officials by rolling back the power of these unions will be a long and difficult fight. The highly visible steps the unions are taking or testing – the direct payment alternative, contracts that temporarily or permanently waive an employee’s right to free speech, forced dues for up to one year after opting-out – can be challenged in court. They may also be politically unpopular – direct payments in particular would be a hard sell to voters.

The more subtle ways unions are buttressing their power in the post Janus environment may be harder to stop, and collectively create daunting barriers to reform. Examples including denying right-to-work and pro-free-speech groups access to public employees, forbidding employers to discuss pros and cons of unionization, mandatory new employee “orientations” with union membership commitments filled with fine print and buried in multiple documents requiring a signature, handing dispute resolutions over to the union-packed PERB instead of the courts, broadening the base of employees eligible to join the unions.

To paraphrase Winston Churchill, for government union reformers the post-Janus era “is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”

This article appears in California Policy Center (californiapolicycenter.org), an educationa nonprofit focused on public policies that aim to improve California’s democracy and economy.