Daily Business Report-April 6, 2018

In some cases, would-be first-time homebuyers are now renting in places they may have bought just a few years ago. (Thinkstock Photo. Courtesy CALmatters)

Big Investment Firms Have Stopped

Gobbling Up California Homes

By Matt Levin | CALmatters

Astronomical prices are forcing a rising share of California families to postpone buying a house. As a result, the state’s record-low homeownership rate has been a boon to one growing segment of California’s housing market: single-family home rentals.

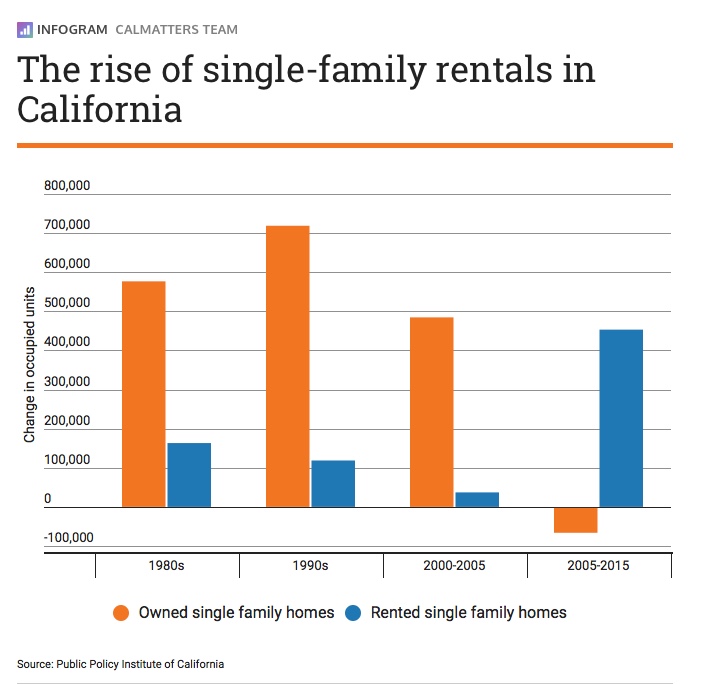

Between 2005 and 2015, the number of owner-occupied homes in California shrunk by nearly 64,000 units, according to the Public Policy Institute of California. Meanwhile the number of renter-occupied homes increased dramatically. California now has 450,000 more homes used as rentals than it did a decade ago. Compare that to the 1990s, when the number of rented homes grew by less than 120,000 while the state added 700,000 homes owned by the people who live in them.

The rising tide of single-family rentals has renewed attention on who actually receives the rent payments that nearly 2 million Californians make each month. Lawmakers and first-time homeowner advocates have been scrutinizing a relatively new form of landlord: private investment firms that snapped up thousands of homes during the foreclosure crisis and now rent them out. With nearly one in four California homes now purchased in all-cash, these well-financed institutional investors have also been blamed as unfair competition against families bidding on starter homes.

So how much are institutional investors impacting California’s housing prices? The data says not so much now.

Institutional investors accounted for less than 2 percent of California single-family home sales last year.

Typically the term “institutional investor” refers to private investment firms that buy dozens of residential properties with the explicit aim of generating a steady income stream through rentals. Often they invest the money of wealthy individuals and public pension funds, like those established for California state workers and teachers.

The best example is Blackstone, a publicly traded Wall Street firm that barrelled into the country’s single-family home market in the depths of the Great Recession in the late 2000s. Through its residential investment-focused subsidiary, Invitation Homes, Blackstone is now the largest owner of single-family homes nationwide. In California, they own about 13,000 homes.

But firms such as Blackstone have stopped buying wide swaths of California homes. According to the real estate data firm ATTOM Data Solutions, which defines institutional investors as entities that buy 10 or more homes in a given year, institutional investors accounted for less than 2 percent of the state’s single-family home and condo sales in 2017.

That’s a pretty steep drop from as recently as 2012, when institutional investors accounted for about 7 percent of sales.

Why the decline? California no longer has a glut of cheap houses that can be easily gobbled up in foreclosure auctions. A sustained economic recovery and a lack of construction of new housing has sent housing prices skyrocketing. It’s now too expensive for institutional investors to buy lots of California homes. Blackstone’s Invitation Homes bought only 82 California houses last year.

“The low inventory and homeownership rates are good (for investors) if they own the property—it means more renters,” says Daren Blomquist, senior vice president at the real estate data firm ATTOM. “But it’s bad if they’re trying to acquire more properties.”

Those all-cash offers beating out would-be homebuyers aren’t coming from large investment firms anymore. Wealthy “mom-and-pop” landlords—families that can afford to buy another house and rent it out as an investment—now dominate the single-family rental market. Among all single-family rentals nationally, about 80 percent are owned by individuals that rent out just one or two homes, according to ATTOM.

But aren’t institutional investors keeping houses off the market—and doesn’t that drive up prices?

Institutional investors aren’t keeping enough homes off the market statewide to blame them wholesale for California’s astronomical housing prices. But in certain local markets—especially in areas hit hard by the foreclosure crisis, such as the Central Valley and Inland Empire—it’s impossible to pretend they have no influence.

Among cities with at least 100,000 residents, Sacramento has seen the most properties sold to institutional investors since 2007, according to ATTOM’s data–about 6 percent of all homes sold in the city during that time span. San Bernardino and neighboring Rialto have seen the largest share of their housing stock bought by institutional investors, at roughly 10 percent. Firms have largely stayed away from Bay Area cities, where the foreclosure crisis was less acute and where housing prices are among the most expensive in the country.

“We do not believe our activity impacts prices at any level,” a spokeswoman for Blackstone subsidiary Invitation Homes wrote in response to questions.

Institutional investors have targeted the typical starter home in these cities—three bedroom, two bath houses at a price point that a few years ago could have been afforded by younger families. So in some cases, would-be first-time homebuyers are now renting in places they may have bought just a few years ago.

Still, investment firm ownership in these areas is much lower than in Atlanta or Phoenix, where they’ve made nearly one in four home purchases. And young families are more likely to rent homes from smaller landlords.

Reports of institutional investors making all-cash offers on California homes caught the attention of state Sen. Ian Calderon, Democrat from Whittier, when he was attempting to move out of his apartment and purchase his first house last year. While the 32-year-old lawmaker acknowledges that institutional investors don’t own a large chunk of California’s housing stock, he says he’s concerned their influence is yet another hurdle for young homebuyers to overcome.

“I just want to be able to have more information about these firms, and ultimately I want to advantage first-time homebuyers,” said Calderon. “I want to make sure that people aren’t getting screwed.”

Multiple attempts by Calderon to impose more transparency on institutional investor activity while blunting their ability to make all-cash offers have not gone far in the Legislature. Two years ago, a bill that would have forced homeowners to wait 90 days before selling to large institutional investors failed to clear both chambers with that provision intact.

Last year, a bill that would have required investors who own more than 100 properties in California to register with the state and provide detailed information on their activities again failed to reach the governor’s desk. Caldeorn says there’s a good chance that bill will be resuscitated this year.

The California Apartment Association, which represents landlords across the state for both multifamily and single-family units, has opposed much of Calderon’s legislation, arguing that much of the information it seeks is available in public stock exchange filings. That’s mostly true, but that only applies to publicly traded firms, and the data is not in the most accessible format.

Landlords also says Calderon’s bill doesn’t address the root cause of the problem.

“The bottom line here is about supply,” said Debra Carlton, lobbyist for the California Apartment Association. “There’s just not enough housing to go around so you end up in these unfortunate situations where people can’t buy and can’t afford a place to rent.”

__________________

Scripps Health Launches

Opioid Stewardship Program

Scripps Health has launched a program that aims to significantly reduce the use of opioids in order to help prevent patients from overdosing or becoming dependent on the powerful pain-reducing medications. Greater use of non-opioid approaches for pain management will be emphasized.

“We can and must do everything possible to reverse this dangerous trend, starting by limiting and monitoring post-discharge opioid usage, and using other proven and effective methods to manage pain,” said M. Jonathan Worsey, M.D., co-chair of the surgery care line at Scripps Health and one of several physicians leading the Scripps Opioid Stewardship Program (OSP).

Key elements of the new Scripps OSP include:

- Educating patients about opioids, including setting realistic expectations for post-surgical pain, how to taper off and maximize other types of pain management and safe disposal of unused opioids.

- Educating medical staff on safe and appropriate opioid prescribing and increasing the role of pharmacists in managing post-operative opioid use.

- Expanding training and use of multimodal pain management, including non-opioid medications such as acetaminophen and ibuprofen, and non-pharmaceutical techniques such as ice or heat, physical therapy, meditation, massage and distractions.

The program at Scripps comes at a time of a nationwide opioid overdose epidemic that has been fueled in part by prescription opioids. According to the Centers for Disease Control and Prevention, 40 percent of opioid-related deaths involve a prescription opioid, including drugs such as oxycodone, hydrocodone and methadone. Each day more than 1,000 people are treated in emergency rooms for misusing prescription opioids, according to the CDC.

“Our goal is to return patients to healthy function as soon as possible without putting them at risk for opioid dependency or the side effects of opioid usage. This means taking advantage of all other pain management options before considering opioids,” said Valerie Norton, M.D., medical director of the emergency department at Scripps Merch Hospital San Diego and medical director of the Scripps Health Pharmacy and Therapeutics Council.

__________________

Four San Diego-Area Educators Honored

with Teach for Innovation Awards

Four San Diego-area educators were honored Thursday night at the second annual Teach for Innovation Awards event, a benefit for Teach for America-San Diego. Nearly 200 educators and community leaders attended the dinner at the Central Library, which raised almost $500,000 to support Teach for America’s work to improve learning opportunities at low-income schools.

The four honorees: Cipriano Vargas, Thomas Ohno-Machado, Carol Cabrera and Dr. Mary Walshok.

Cipriano Vargas is a Vista native who taught kindergarten with Teach For America-San Antonio before returning home and becoming the youngest member ever elected to the Vista Unified School Board. Vargas received the McGrory Award for Alumni Leadership and a $2,500 stipend.

Thomas Ohno-Machado, a special education teacher at Center for Children, was recognized with the Award for Diversity, Equity and Inclusion. He is a first-year corps member with Teach For America-San Diego and the founder of Fast n’ Furious Meal Delivery, a student-run business that is training people with disabilities to live independently.

Carol Cabrera, a humanities teacher who integrates physics, math and Spanish into her project-based lessons at High Tech High, got her start with Teach For America-Mississippi Delta. She was honored with the Benbough Award for Innovative Use of Technology in a Classroom and a $2,500 stipend.

Dr. Mary Walshok is associate vice chancellor for public programs and dean of Extension at UC San Diego. She received the Honorary Teach for America Alumni Award in recognition of her lifelong commitment to innovation in education. Walshok has spearheaded many efforts to strengthen the talent pool in San Diego over the past 30 years, most recently establishing a program that allows high school students to simultaneously earn college-level certificates.

The Teach For Innovation Awards were started in 2017 by David Lopez, the executive director of Teach For America-San Diego, as a way to recognize forward-thinking and high-achieving teachers who are dedicated to ensuring educational equity and excellence for the students of San Diego.

__________________

Jefferson Professional Building

in Carlsbad Sells for $3.34 Million

Orange Land Holdings, LLC, a San Diego-based investor, has acquired the Jefferson Professional Building in Carlsbad Village for $3.34 million.

The 10,904-square-foot building, located at 2910 Jefferson St., is rated as Class B office/medical. The two-story building is elevator served and features both surface and subterranean parking.

Cushman & Wakefield represented the buyer. The seller was not identified.

__________________

General Atomics’ Avenger Remotely

Piloted Aircraft Sets Endurance Record

General Atomics Aeronautical Systems Inc. (GA‑ASI) has set an endurance record with its Avenger Extended Range Remotely Piloted Aircraft. On Jan. 24-25, the next-generation Avenger ER flew 23.4 continuous hours in a representative Intelligence, Surveillance and Reconnaissance configuration while carrying out a simulated reconnaissance mission. This exceeded the 20 hour flight test goal and reflects a 10 hour improvement over the baseline Predator C Avenger aircraft. Combined, the Avenger and the Avenger ER have accumulated over 20,000 flight hours.

“Avenger ER continues to meet and exceed its development goals,” said David R. Alexander, president, aircraft systems, GA-ASI. “By setting this new high endurance mark, we have demonstrated the tremendous capability of this aircraft to our customers.”

__________________

Terminix: San Diego the 5th Most

Termite-Infested City in Country

Terminix, a termite and pest control company, revealed the 25 most termite-infested cities in the country. San Diego was 5th on the list. Termites were most prevalent in Houston in 2017, followed by Los Angeles Mobile, Ala. and San Antonio.

The ranking was created by compiling termite-specific data of services rendered at more than 300 Terminix branches across the country. The rankings represent Metropolitan Statistical Areas (MSAs) with the highest number of actual services between Jan. 1, 2017 and Dec. 31, 2017.

__________________

San Diego 5th in Dog Attacks on Postal Workers

San Diego also ranked 5th in a list of 30 cities reporting the most postal attacks by dogs, according to the U.S. Postal Service. The agencysaid the number of postal employees attacked by dogs nationwide reached 6,244 in 2017, more than 500 fewer than 2016. In San Diego, there were 46 attacks in 2017, down from 57 in 2016.

Linda DeCarlo, U.S. Postal Service safety director, was in San Diego Thursday to promote National Dog Bite Prevention Week, which runs April 8-14.

__________________

Cal/OSHA Cites Escondido Roofing

Contractor for Repeat Fall Hazard Violations

Cal/OSHA cited California Premier Roofscapes Inc. of Escondido for repeat violations of fall protection safety orders and proposed $134,454 in penalties. The company was investigated and cited on six different occasions over the past four years for putting its workers at risk of fatal falls.

Cal/OSHA opened the most recent inspection in August 2017 after receiving a report that workers were not wearing proper fall protection while installing tiles on the roof of a three-story Chula Vista home. Inspectors found that CaliforniaPremier Roofscapes failed to ensure their workers were wearing safety harnesses and other personal fall protection. Employees were not properly trained on fall protection and roof work hazards.

“California Premier Roofscapes has repeatedly put its workers at risk of potentially deadly falls from heights, disregarding basic safety requirements to protect its employees,” said Cal/OSHA Chief Juliann Sum.

__________________

State Dept OKs Germany’s $2.5 Billion

Request for Northrop MQ-4C Triton Drones

The State Department has given Germany the green light to procure four Northrop Grumman-built MQ-4C Triton unmanned aircraft systems from the U.S. government through a potential $2.5 billion foreign military sales agreement. Northrop and Airbus’ defense and space business will serve as prime contractors in the proposed FMS deal in support of the European country’s intelligence, surveillance and reconnaissance efforts and security of NATO and the European Union, the Defense Security Cooperation Agency said.

Northrop will oversee payload installation, integration and functional compatibility testing, while Airbus’ defense and space business will manage development and production activities as well as related testing initiatives.

The transaction calls for the delivery of a modified version of the U.S. Navy’s Triton drone configuration and includes a mission control station, a Rolls Royce engine, mission planning element, communication equipment, spares and repair parts, logistics, technical assistance and engineering services to support the installation and testing of Germany’s payload.

The proposed sale will require the deployment of contractor representatives to Germany to help set up security infrastructure and provide logistics support.

__________________

Personnel Announcements

Erika Brooks Joins Colliers International

Erika Brooks has joined Colliers International San Diego Region as an associate vice president specializing in industrial property sales and leasing in East County.

Brooks will be based in Colliers International’s UTC office.

Brooks holds more than 14 years of commercial development, market research, sales, leasing and property management experience in San Diego County.

She was most recently affiliated with Pacific Coast Commercial and earned a Bachelor of Arts in Communication from California State University, San Marcos.