Daily Business Report-Oct. 29, 2015

There was a heavy drop in building permits in August and September.

San Diego County Economy Slowing Down

Declines signal a turning point

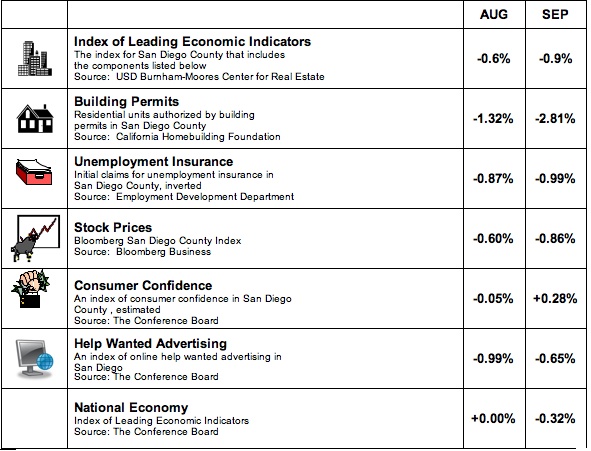

The USD Burnham-Moores Center for Real Estate’s Index of Leading Economic Indicators for San Diego County fell 0.6 and 0.9 percent, respectively in August and September.

Both months featured a big drop in building permits, as well as negative moves in unemployment insurance, local stock prices, and help wanted advertising. Consumer confidence followed a very slight drop in August with a gain in September, while the outlook for the national economy was flat in August before falling in September.

With the declines in August and September, the USD Index has now decreased for three consecutive months, the traditional signal of a turning point in the local economy.

While the local economy is not expected to go into a full-blown recession, there is likely to be a slowing in the labor market, with job growth sliding from its current 40,000+ rate and the drop in the local unemployment rate leveling off, both in the second half of 2016.

Contributing to this slump are uncertainties in the national and international economies, the recently announced layoffs at Qualcomm, weakness in the labor market components of the USD Index and a big decline in planned construction activity.

________________________________________________

Taxpayers Association Says

Water Rate Increase Justifiable

By City News Service

The San Diego County Taxpayers Association gave its blessing Wednesday to the city of San Diego’s plan to raise water rates by 9.8 percent in January, and an additional 6.9 percent next July 1. The proposed increases are based on a cost of service study that projects rising expenses in the future.

“The city’s Public Utilities Department has made a solid case for its rate increase, including demonstrating they’re using ratepayer dollars more efficiently,” said Theresa Andrews, interim president and CEO of the San Diego County Taxpayers Association.

Department officials said they’re faced with higher costs for imported water, and water from the desalination plant in Carlsbad that’s coming online soon is also expected to be more expensive. At the same time, departmental revenues are falling because customers have cut back on consumption — as requested by city and state officials — in response to the drought.

The San Diego County Taxpayers Association Board of Directors said the rate increase request was justifiable, as was a plan to hike rates for recycled water, which is largely used by commercial buildings, hospitals and schools.

Halla Razak, the public utilities director, said the department could fall behind on debt service if the rates aren’t raised, which would look bad to credit agencies and maybe increase the cost of future infrastructure projects.

A residential customer whose monthly bill is now around $36 would see a hike to a little over $39, according to a city report.

The department’s proposal also foresees possible rate hikes in 2017, 2018 and 2019, based on projections of future costs for imported water, which makes up 85 percent of the city’s total.

The City Council is scheduled to hold a public hearing on the rates, and possibly make a decision, on Nov. 17. Notices of the public hearing have been mailed to customers.

The council last voted to raise water rates in November 2013, when the hike was more than 7 percent. However, a department presentation says the average monthly bill of $70.81 is below the average of the various water districts in San Diego County, which is just over $78.

_____________________________________________

Salk Study:

Bipolar Patients’ Brain Cells More

Sensitive to Stimuli Than Other People’s

The brain cells of patients with bipolar disorder — characterized by severe swings between depression and elation — are more sensitive to stimuli than other people’s brain cells, researchers for the Salk Institute for Biological Studies have discovered.

The finding, published October 28, 2015 in the journal Nature, is among the first to show at a cellular level how the disorder affects the brain. Moreover, it reveals why some patients respond to treatment with lithium while others don’t.

Salk scientists discover cellular differences between brain cells from bipolar patients that respond to lithium and those that don’t. Neurons (white/red) from a subset of bipolar patients show changes in their electrical activity in response to lithium.

“Researchers hadn’t all agreed that there was a cellular cause to bipolar disorder,” says Rusty Gage, a professor in Salk’s Laboratory of Genetics and senior author of the new work. “So our study is important validation that the cells of these patients really are different.”

Bipolar disorder affects more than 5 million Americans and is often a challenge to treat. If patients’ severe mood swings aren’t helped with lithium, doctors often piece together treatment plans with antipsychotic drugs, antidepressants and mood stabilizers. But they often help only the depressive swings of bipolar or the opposing manic swings, not both.

To study the underlying cause of bipolar disorder, Gage and his colleagues collected skin cells from six bipolar patients, reprogrammed the cells to become stem cells, and then coaxed the stem cells to develop into neurons. They then compared those neurons to ones from healthy people.

“Neurons are normally activated by a stimuli and respond,” says Jerome Mertens, a postdoctoral research fellow and first author of the new paper. “The cells we have from all six patients are much more sensitive in that you don’t need to activate them very strongly to see a response.”

Eight Researchers Selected to Pursue

Promising Alzheimer’s Disease Cure

Eight world-class researchers have been selected by Collaboration4Cure, a local grant program established last year, to pursue promising Alzheimer’s drug discovery projects.

They will be given direct access to state-of-the-art equipment, resources and expertise at Sanford Burnham Prebys Medical Discovery Institute and The Scripps Research Institute.

The goal of Collaboration4Cure is tap into the region’s best minds and resources to increase the success of finding chemical compounds that can attract further external funding and foster the development of a pipeline of possible therapeutic drugs for Alzheimer’s disease.

“Sanford Burnham Prebys Medical Discovery Institute is proud to be part of C4C,” said Michael Jackson, MD. “San Diego is home to some of the best neuroscientists in the world, and with our advanced screening and drug discovery capabilities at the Conrad Prebys Center for Chemical Genomics, we hope to quickly advance research to prevent, treat, and even cure this terrible disease.”

The grant recipients:

• Dr. Albert La Spada, rofessor, UC San Diego School of Medicine, Department of Cellular & Molecular Medicine.

• Dr. Matthew Pearn, assistant clinical professor, UC San Diego School of Medicine, Department of Anesthesiology.

• Subhojit Roy, associate professor, neuropathology, Department of Pathology, UC San Diego.

• Steve L. Wagner, associate professor, School of Medicine, Department of Neuroscience, UC San Diego.

• Huaxi Xu, program director, Neurodegenerative Disease Program, professor, Department of Neuroscience & Aging, UC San Diego.

• Elena Pasquale, professor, Tumor Initiation & Maintenance Program, Cancer Center.

• Lutz Tautz, research assistant professor, NCI-Designated Cancer Center.

• Yunwu Zhang, research assistant professor, Department of Neuroscience and Aging.

Baja, U.S. Rail Link Gets

New York Financial Backing

By the Times of San Diego

Plans to re-open a 70-mile rail link between the factories in Baja California and the U.S. railroad network got a significant financial boost Wednesday when controlling interest in the project was acquired by New York investment company.

Conatus Capital Group acquired majority interest in the Pacific Imperial Railroad and named Arturo Alemany, an international business executive with 10 years of railroad experience, as CEO of the company.

“I am excited to be part of PIR, and join in the reconstruction of the Desert Line,” said Alemany. “The project is a major regional international economic development initiative that has the support of the best qualified investors, advisors and representation that will significantly improve the movement of goods along this section of track.”

The reconstructed line will run from the border to connect with the Union Pacific Railroad in Plaster City, giving some 650 manufacturing facilities — many of them U.S. owned — rail access to the U.S. market.

The Desert Line was completed by visionary San Diego businessman John D. Spreckels in 1919, but major sections were destroyed by Hurricane Kathleen in 1976 and the line has had a checkered history since then.

Quidel’s 3rd Quarter Revenues Grow

14 Percent, Beat Analysts’ Estimate

San Diego-based Quidel said after the close of the market on Wednesday that third quarter revenues grew 14 percent to $46.8 million from $41.2 million in Q3 2014, beating the average analyst estimate of $43.5 million. The increase was driven by sales of the firm’s Sofia immunoassay products as well as other new products, which increased by 76 percent year-over-year to $16.6 million. Meanwhile, molecular revenues increased 52 percent year over year.

For the quarter ended Sept. 30, R&D expenses at the company totaled $8.4 million, a 37 percent decrease from $11.5 million, while SG&A expenses inched up 4 percent to $18 million from $17.3 million in the year-ago quarter.

“We believe that the investments that we have made thus far has put us in a position to grow annual revenues reliably at a rate of about 10 to 15 percent, assuming a reasonably normal respiratory disease season,” Quidel President and CEO Douglas Bryant said in a conference call recapping the company’s earnings.

Quidel’s Solana platform and Group A Streptococcus test were granted 510(k) clearance from the US Food and Drug Administration in late Q2 and the firm launched the system and test in August as a moderately complex assay. Bryant characterized initial sales as “very encouraging,” noting that the firm intends to submit this and other assays for CLIA waiver in the future.

Quidel’s net loss for the quarter shrunk to $762,000, or $.02 per share, from $5.8 million, $.17 per share, in Q3 2014. On a non-GAAP basis, its net income for Q3 was $1.7 million, or $.05 per share, compared to a net loss of $502,000, or $.01 per share, for the same period in 2014. The firm beat the consensus Wall Street estimate for a loss of $0.14 per share.

Quidel ended the quarter with cash, cash equivalents, and restricted cash of $184.4 million.