Daily Business Report-Jan. 21, 2014

Jay Flatley, chief executive officer of Illumina, introduced the gene sequencing machine at an investors conference in San Francisco.

Illumina’s New Low-Cost Genome Machine

Stands to Change Health Care Forever

In 2003, the cost of sequencing a human genome was $500 million. Thanks to San Diego’s Illumina, the cost today is down to $1,000. For years, modern science has been on a quest to affordably sequence the human genome.

Illumina, the world’s leading seller of gene sequencing machines, unveiled its HiSeq X (pronounced “High Seek 10”) recently. The system is the world’s first DNA-crunching supercomputer designed to process 20,000 genomes per year at a cost of $1,000 each. Although Illuminia may be the first to reach this hallmark, many other San Diego players, including Life Technologies and Craig Venter, have been involved in efforts to find an affordable way to sequence our DNA, proving some of the best scientific minds are right in our backyard.

Jay Flatley, Illumina’s chief executive officer, introduced the machine at an investors conference in San Francisco, saying customers will begin receiving the machine this quarter. “This will be a blockbuster product,” he said in an interview with Bloomberg Businessweek.

The high-speed, low-cost sequencing system arrives at a crucial time, with a number of biotech companies, research centers, and hospitals starting to show real clinical breakthroughs. “To figure out cancer, we need to sequence hundreds of thousands of cancer genomes, and this is the way to do it,” Flatley said.

Forclosures in San Diego County Fall to 8-Year Low

The number of San Diego County homeowners pulled into the formal foreclosure process dropped to an eight-year law last quarter, the result of an improving economy, foreclosure prevention efforts and higher home prices, according to DataQuick, a San Diego real estate information service.

A total of 1,302 Notices of Default were recorded in the fourth quarter of last year — a drop of 51 percent from the 2,655 recorded in the same quarter of 2012.

Trustees Deeds recorded in the county, or the finalized loss of a home to the formal foreclosure process, totaled 471 in the fourth quarter of 2013, a decline of 63.3 percent from the 1,285 recorded in the fourth quarter of 2012.

Statewide Figures:

Statewide, a total of 18,120 Notices of Default were recorded by lenders and their servicers on California owners of houses and condos during the October-through-December period. That was down 10.8 percent from 20,314 for the prior quarter, and down 52.6 percent from 38,212 in fourth-quarter 2012. Last quarter’s tally was the lowest since 15,337 NoDs were recorded during fourth-quarter 2005. NoDs peaked in first-quarter 2009 at 135,431. DataQuick’s NoD statistics go back to 1992.

“Some of this decline in foreclosure starts stems from the use of various foreclosure prevention efforts — short sales, loan modifications and the ability of some underwater homeowners to refinance,” said John Walsh, DataQuick president. “But most of the drop is because of the improving economy and the increase in home values. Fewer people are behind on their mortgage payments. And of those who do get into trouble, many, if not most, can sell and pay off what they owe. Also, those who are underwater and close to slipping into foreclosure are far less likely to give up their homes now that appreciation has returned to the housing market. There’s a strong incentive to hang on.”

The median price paid for a California home was $364,000 in the fourth quarter, up 22.1 percent from $298,000 a year earlier. The median has risen more than 20 percent on a year-over-year basis for the last five quarters. It peaked in second-quarter 2007 at $485,500 and hit bottom at $235,000 in second-quarter 2009, DataQuick reported.

On primary mortgages, California homeowners were a median 8.7 months behind on their payments when the lender filed the Notice of Default. The borrowers owed a median $20,066 on a median $302,000 mortgage.

On home equity loans and lines of credit in default, borrowers owed a median $5,491 on a median $68,770 credit line. The amount of the credit line that was actually in use cannot be determined from public records.

The most active “beneficiaries” in the formal foreclosure process last quarter were Wells Fargo (3,287), JP Morgan Chase (1,182) and Nationstar (1,096).

The trustees who pursued the highest number of defaults last quarter were Quality Loan Service Corp (for Wells Fargo and others), Trustee Corps (OneWest Bank and Green Tree) and Northwest Trustee Services (JP Morgan Chase).

Trustees Deeds recorded totaled 8,205 last quarter – the second-lowest level in seven years, behind third-quarter 2013. Last quarter’s foreclosure total was up 2.2 percent from 8,030 during third-quarter 2013 and down 61.2 percent from 21,127 during fourth-quarter 2012. The all-time peak was 79,511 foreclosures in third-quarter 2008. The state’s all-time low was 637 in second-quarter 2005, DataQuick reported.

San Diego County Industrial Market in Growth Mode

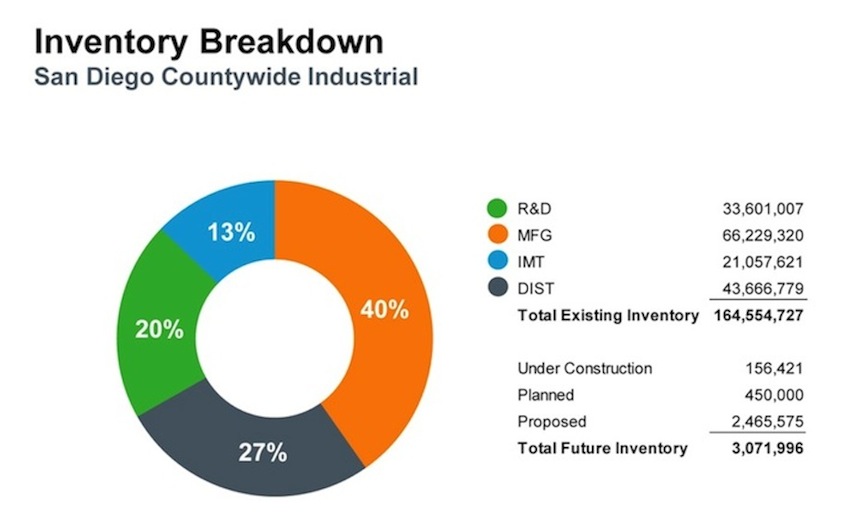

The San Diego County industrial market is in a long-awaited growth mode after closing out 2013 with its 10th consecutive quarter of positive net absorption, according to a year-end report by Cassidy Turley, a commercial real estate company.

The report said the 559,267 square feet of industrial activity recorded in the fourth quarter contributed to 2.3 million square feet of positive net absorption for the year, a pace well ahead of the average of 1.5 million square feet in the post-recession years of 2010 to 2012. The report also shows that the third and fourth quarters of 2013 were the first two consecutive quarters of positive absorption across all industrial product types in seven years.

“The market’s 2013 performance indicates that the improving demand for industrial space is sustainable for the foreseeable future across all product types,” said Bryce Aberg, managing director with the San Diego office of Cassidy Turley. “Over the last four years, the San Diego industrial market has absorbed 6.7 million square feet, more than recouping the 4.2 million square feet that was returned to the market in 2009 —the worst year of the recent recession.”

The Cassidy Turley report shows that countywide total vacancy for all product types (including sublease space) has declined for 10 consecutive quarters to 7.8 percent. This compares to 9.5 percent the same time a year ago and is well below the peak rate of 12.7 percent recorded in the fourth quarter of 2009. It is also nearly on par with the market’s pre-recession low of 7.6 percent in 2006.

County Water Authority Says No Need

for Water-Use Restrictions in Region

Despite a statewide drought declaration on Friday, the San Diego County Water Authority says there’s no need for countywide water-use restrictions. The region has adequate supplies for 2014 because of “local investments in diverse and more reliable water supplies over the past two decades and a long-term decrease in regional water demand,” the agency said.

The agency did say that it is closely monitoring hydrologic conditions across the Southwest and is encouraging residents and businesses to use water as efficiently as possible to avoid water waste.

The San Diego region imports about 85 percent of its water supplies. This year’s imports from the State Water Project are expected to be very low due to low water storage levels in that system, poor hydrological conditions and regulatory restrictions. However, the Water Authority’s largest provider of water — the Metropolitan Water District of Southern California — has said it has adequate stored water reserves and doesn’t expect to impose allocations this year.

The governor’s drought declaration calls for Californians to reduce water use by 20 percent. Per capita water use in the San Diego region has decreased about 27 percent since 2007, and local cities and water districts are on pace to meet their state-mandated water-efficiency targets for 2020, the Water Authority said. Total regional consumption of potable water in 2013 was 24 percent lower than in 2007.

Scripps Health CEO to Get Gold Medal Award

Scripps Health President and CEO Chris Van Gorder will be honored by the American College of Healthcare Executives with a Gold Medal Award at the opening session of the organization’s 57th Congress on Healthcare Leadership in Chicago on March 24. Van Gorder will be recognized for his significant contributions to the health care field on behalf of a health care delivery organization. He served on the Board of Governors from 2006 to 2008 and as chairman-elect, chairman and immediate past chairman from 2009 to 2012.

Van Gorder continues to serve the public as a reserve commander in the San Diego County Sheriff’s Department Search and Rescue Unit, where he is the commander.

Gafcon Launches Online Tool for School Districts

Gafcon Inc. announced the launch of QualityBidders, an automated online tool that enables California school districts to prequalify construction contractors in order to comply with a new state law. The law, California Assembly Bill 1565, mandates that school districts must now prequalify both general contractors and mechanical, electrical and plumbing subcontractors. Previously, prequalification was voluntary, and only required for general contractors. The new law applies to all districts in the state with more than 2,500 students and with contracts valued at $1 million or more, funded entirely or in part by state bond funds.

“We are finding that many districts have been caught unprepared for this change, which poses a tremendous burden on their staffs and puts their projects at risk,” said Gafcon CEO Yehudi “Gaf” Gaffen. “We have developed an online tool that streamlines the entire prequalification process, allowing districts to become compliant in just one day, while saving significant time, money and resources.”

With QualityBidders, the automated system gathers all of the necessary information from contractors through a standardized questionnaire. The system then uses software algorithms to score the data, emails a status update to the applicants, and automatically creates the mandatory reporting for compliance.

The Grossmont Union High School District is using QualityBidders as part of its $417 million Proposition U school bond program.

Wayne Rosenbaum Joins Opper & Varco as New Partner

Attorney Wayne Rosenbaum has joined the San Diego environmental law firm Opper & Varco LLP as a partner. Rosenbaum has practiced environmental law in San Diego for more than a decade. His practice will include land use and natural resources law, with an emphasis on water quality and land use laws affecting infrastructure and renewable energy projects. He will help develop compliance strategies regulated under the storm water provisions of the Clean Water Act, the Endangered Species Act, the California Environmental Quality Act and other state and federal resources statutes.

Prior to joining Opper & Varco, Rosenbaum was a partner in the environmental regulation group at Stoel Rives LLP, where he focused on a variety of renewable energy, infrastructure and development projects.

Rosenbaum is an adjunct professor, teaching land use and water law at Thomas Jefferson School of Law.

Sierra Spitzer is New Partner at Schwartz Semerdjian

Sierra J. Spitzer has joined Schwartz Semerdjian Ballard & Cauley LLP as a partner. Spitzer represents individuals and businesses in a variety of civil litigation matters, with a focus on labor and employment issues, personal injury and business litigation, and has appeared on behalf of and defended clients in investigations by state and local agencies.

She also works with corporate counsel, human resource personnel, insurance companies and business owners, providing counseling and assistance in prevention, investigation and early resolution of business, personal injury and employment related issues.

Spitzer currently serves as the v ice chair of both the Employment Law & Litigation Committee and the TortSource Editorial Board for the Tort Trial and Insurance Practice Section of the American Bar Association. She has also served on the Young Lawyers Division Executive Committee of the San Diego County Bar Association.

Spitzer graduated from the University of Puget Sound and Santa Clara University School of Law.