Loosening the purse strings

Banks are lending again, and the SBA is leading the charge

By Kris Grant

A year after the financial market’s near-collapse, banks are beginning to loosen their purse strings. And the Small Business Administration (SBA) is offering enticing products that are bringing reticent banks back into the business of lending.

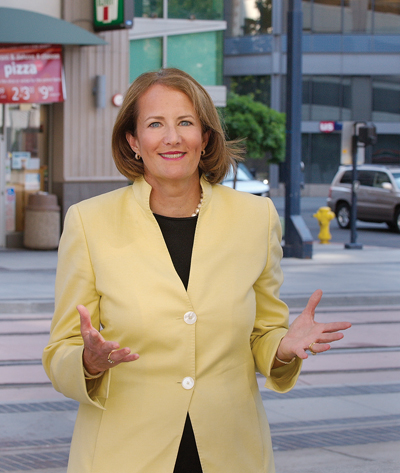

When Karen Mills was appointed administrator of the SBA last April by President Barack Obama, she’s the first to tell you that she took the helms at the most challenging of times. Until the Recovery Act, lending, including SBA lending, had come to virtually a stand-still.

Mills visited the Downtown San Diego offices of the SBA last month after speaking at a private function in Carlsbad, and reported on the progress of her first six months on the job. She says her agency’s report card is good, particularly in the areas of stimulating bank lending activity.

“We’ve been able to get about $10 billion of the $730 billion Recovery Act funds into the hands of small business,” she said.

Two new programs from the Recovery Act funding allow reduced borrower fees and increased guarantees on flagship loans up to 90 percent.

“We were immediately able to see banks coming back into the program,” Mills said. “Loan volume is up over 60 percent and, most interestingly, about 1,000 banks which had not made a single SBA loan from October on are back in the program, lending again. About half hadn’t made a loan since 2007. With more community banks lending, this means more access for small business.”

San Diego SBA District Director Ruben Garcia said there are about 87 San Diego-area banks that offer SBA loans, 67 of which are community banks, the remaining 20 are branches of national banks. To be a preferred SBA lender, the bank must make 40 or 50 loans. Once they are certified as a “PLP,” the SBA delegates the authority to the bank to issue its guarantee and handle all servicing of the loan. Garcia says 56 PLPs are in place in San Diego.

Mills said that reduced or eliminating a lot of the loan fees enabled banks to package loans and sell them to the secondary market. “Now they can take the capital and get liquidity back. This was not functioning in October,” Mills said.

Another new SBA program financed under the Recovery Act is what Mills terms “a bridge over troubled waters,” The loans allow businesses to borrow up to $35,000 over six months that are 100 percent guaranteed to the lenders who make them.

“We have the ability to make about 10,000 ARC loans,” Mills said, admitting this is an unusual program for the SBA. “We have over 2,000 loans with 500 banks, and we’re making loans with 50 new banks every week. People who have come in for these loans have to show a slowdown in business and have to prove they are viable. They have to show their next quarterly cash flows. It’s a good loan for the right type of business and we can potentially help 10,000 businesses.”

Darlene Goodbody, owner of Good Body Gear Inc., of Lakeside, received an ARC loan last month. Her company machine fabricates offshore oil down-hole components. “We weld fiber-optic components,” she explains, adding that she has been in oceanography for over 20 years. “We needed an ARC loan because one of our biggest customers, an oil field, had a 50 percent drop-off on productivity. There’s less surveying out there.”

Now Goodbody’s company is transitioning into the aerospace industry, working on proprietary technology for F-18 fuel nozzles at North Island Naval Air Station. “It’s a slow recovery for our business, but we’re seeing a significant rise. And with this loan, we don’t have to pay it back to 2011,” she said, relief evident in her voice.

The largest SBA lender locally is CDC Small Business Finance, one of about 260 nonprofit certified development companies across the country that markets and packages SBA commercial real estate, land and large equipment purchase loans. The nonprofit always partners with financial institutions, doing a lot of local business with Wells Fargo, Bank of America, California Bank and Trust and Torrey Pines Bank. (Wells Fargo is the second largest volume SBA lending institution locally).

The average San Diego SBA loan financed through CDC Small Business Finance is $600,000 (CDC’s share), says Larry Nuffer, company spokesperson. The interest rate in September was 5.14 percent, which is the lowest in the history of the project for any CDC in the country. The other half of the loan is financed through a bank, which charges a competitive loan rate. A 20-year time span is typically, although 10-year time frames are also available.

“Say a loan is $1 million,” said Nuffer. “A bank will loan $500,000, then partner with us for $400,000 (that’s the 40 percent government-guaranteed portion) and the customer only has to put up 10 percent.”

But it’s not just SBA lending that banks are pursuing these days.

At Security Business Bank, which has offices in Carmel Valley, Carlsbad and Downtown San Diego and $220 million in assets, Paul Rodeno has been CEO since the bank’s founding in 2002. He says his bank is most certainly lending. Yes, it’s doing SBA loans (the bank is a Preferred SBA Lender) but also general business loans.

“Fortunately or unfortunately, the rules have not changed,” says Rodeno.

“We’re lending to companies that have a track record of profitability, are well capitalized, and have good sponsoring,” he said. “By sponsoring, that means the principals know what their doing and have reasonably good balance sheets themselves and will support the company through personal guarantees.”

Ninety percent of Security Business Banks’ business is lending to businesses, mostly through lines of credit for working capital, equipment purchases and real estate. Occasionally, the bank lends to individuals of the company. “We’re not a transactional lender, we’re a relationship lender,” Rodeno says. “Some of our borrowers are professionals, accountants, lawyers and engineers.”

Because so much of its real estate lending has been (business) owner-occupied, its non-performing loan ratio is very low, about 1.4 percent of total assets.

For the economy as a whole, Rodeno foresees a long road back, noting “we have a lot of unemployment to work our way through.” But he sees Security’s situation as one with excellent stability, good capital and a strong core deposit base. “We’re very much deposit oriented,” he said. “And we enjoy large depositors; that’s one of the strengths of the company.”

At California Bank & Trust, San Diego Division President Tory Nixon says that his bank never stopped lending, not even after last October’s near financial meltdown.

“We were lending in October or November,” Nixon said. “A lot of the big money center banks stopped lending anywhere near the levels they had traditionally but a lot of more regional and community banks like us continued to lend. We consistently have had a stream of new loan applications.”

Indeed, the bank has approved $160 million in new credit applications in San Diego over the last 12 months. “If they qualified and had cash flow, we were and are ready to lend,” said Nixon. “But you have to remember, that the demand dropped as well, so it was a combination of two forces – big banks not lending and less demand.”

Like Security, California Bank & Trust is a relationship bank, meaning that they are willing to lend to business customers who have a full relationship with the bank. “Typically our customers have a credit relationship as well as a deposit relationship, checking accounts, merchant service, complex cash management, working capital – everything they do from a banking relationship is with us,” said Nixon.” We also provide financing for mortgages to principals who bank with us.”

Nixon said the bank is acquiring more “relationships,” i.e., customers, as banks that were struggling have either closed or been acquired over recent months. “Business customers are looking for banks that are strong enough to lend,” he said. “Many financial institutions have had to terminate bankers, many of whom are still looking for work, during a period of consolidation to cut costs.”

As an SBA preferred lender, Nixon saw supply and demand for SBA products “throttle down big time six to nine months ago.” “There was very little activity; and both he 7A and 504 programs went almost to a screeching halt,” he said.

“But the 7a has become much more vibrant recently and I also think there has been some pent-up demand,” he said

“The good news is that there is activity all across the board coming back across the debt market,” said Nixon. “And the SBA is doing a very good job getting thae products to meet the needs of the borrowers and the banks. People are starting to see the light at the end of the tunnel.”

Mills notes that there are more Recovery Act dollars to come and the spending is continuing. “I’ve written to every governor to make sure that it finds its way into the hands into small businesses,” she said. And while she has yet to meet Gov. Arnold Schwarzenegger in her current role as SBA head, “ I know he is a big supporter of small business.”

The SBA is responsible for making sure that 23 percent of all government contracts go to small business, said Mills, noting that Vice President Joe Biden has paid a lot of attention that a significant portion of Recovery Act moneys go to small business, particularly women owned, veteran owned and minority owned. “These are businesses that we spend a lot of time helping grow and we’re happy that we are at those numbers, particularly with minority-owned businesses,” Mills said.

“This president,” Mills stresses, “is really committed to small business and understands that small business drives the economy and is part of the path to middle class prosperity. That’s why he cares about health care, that’s why we are working collaboratively with the Department of Commerce, Labor, the Veterans Administration and the Department of Energy on programs that will help small business and entrepreneurs.”

Mills says the SBA has a “bone structure” that includes 2,000 employees at the agency, working in 68 field offices, 900 small business development centers, 100 women-owned business centers and 350 chapters of SCORE (the agency’s Service Corps of Retired Executives). “That’s 14,000 people in the field, counseling and interacting with small businesses. It’s where the rubber meets the road, providing connections to local economic development and to government programs and access to capital.”

Mills is also a proponent in recognizing the collaborative power of “regional economic clusters, comprised of small business owners, researchers, educators and is exploring with the departments of Commerce, Labor, Energy and the Veterans Administration how to drive even more innovation and job creation through such clusters.

Recently, Mills was in Michigan where she met with automobile suppliers who worked in the area of robotics. “Now the department of Defense is interested in unmanned drones,” she said. “We found that we could be good matchmakers in opening up new markets, repurposing manufacturing. It was good for the Department of Defense and it was great for these former automotive suppliers. San Diego has long been a hotbed of cluster activity, particularly biotech and the military. And I understand that San Diego has a growing Cleantech cluster and that would support economic growth.”

Mills says that the legal definition of small business varies depending on the industry, with wide differences, for example, between accounting and manufacturing. But generally, small businesses employ under 500 people.

“Generally, half of the people in America either own or work for small business,” she said. “So they are a very powerful part of the economy. And it’s very important to the SBA that we provide loan capital. Small businesses often grow into big businesses – Ben and Jerry’s, Intel and Staples were all funded by SBA loans at one time.”

Mills’ father and mother, Melvin and Ellen Gordon, are chairman/CEO and president/COO respectively of Tootsie Roll Inc., now a public company that includes 22 of the world’s favorite candy brands. The company was started in 1896 by Mills’ Austrian-immigrant grandfather, Leo Hirshfield, who opened a tiny candy shop in New York City.

“I grew up in small business and a family-owned business,” said Mills. “And my parents’ story is a living example of what the president is talking about. You can come to this country and with hard work enjoy a good life. My parents work very hard, they work every day. And they have concern for everyone who works for their company. These are the values I grew up with and they are my values today.”